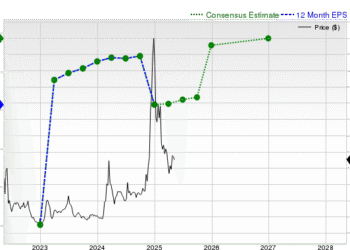

Barrick Gold’s impressive performance in Q4 highlights the company’s resilience and commitment to growth in the competitive mining sector. The North American operations played a pivotal role, consistently meeting production guidance while also pushing forward the Fourmile project update in Nevada. With a significant increase in gold production by 15% and a remarkable 33% rise in copper production, Barrick has positioned itself as a leader in mineral extraction. The latest Barrick Gold Q4 results reveal a year-on-year operating cash flow surge of 20% to US$4.49 billion, coupled with a doubling of free cash flow to US$1.32 billion. This robust financial performance certainly enhances Barrick’s reputation in the industry and underscores its dedication to sustainable value creation and organic growth.

The recent outcomes reflect Barrick Gold’s strategic prowess within the mining industry, particularly highlighted by their latest quarterly results. With the advancements made in their North American ventures and an eye on the Fourmile project, the company’s operational capabilities are markedly on the rise. Notably, the uptick in gold production signals a thriving operational landscape, while a pronounced copper production rise indicates strong demand. Barrick Gold is redefining its market position through enhanced yearly earnings and an aggressive approach to expanding its resources. These developments portray a vibrant future for Barrick and its stakeholders, solidifying its foundation in the competitive landscape.

Barrick Gold Performance: A Strong Finish to Q4

Barrick Gold’s strong performance in Q4 was largely driven by its North American operations, which not only met production guidance but also significantly contributed to the overall financial health of the company. This quarterly success is reflected in a remarkable year-on-year operating cash flow increase of 20%, totaling US$4.49 billion. Such financial robustness is crucial as Barrick continues to focus on sustainable growth and maximizing shareholder value, aligning with its strategic vision.

With free cash flow more than doubling to US$1.32 billion, Barrick Gold is clearly in a position of strength heading into the next fiscal year. The company’s performance underscores the effectiveness of its management in navigating market challenges while leveraging its premier asset base, particularly in the context of gold and copper production increases. As Barrick looks to advance projects like the Fourmile initiative, the consistent upward trends in operating results reaffirm investor confidence.

Gold and Copper Production Increases: Year-on-Year Success

Barrick Gold recently announced significant increases in its gold and copper production, with a notable 15% rise in gold and a staggering 33% increase in copper output compared to Q3. These impressive figures not only meet the company’s annual production guidance but also highlight Barrick’s efficiency in resource extraction and operational management. The full-year financial report indicates a 69% increase in net earnings, showcasing Barrick’s capability to enhance productivity and financial performance in a competitive marketplace.

The growth in production directly correlates with Barrick’s strategic focus on maximizing output from its existing operations while also investing in exploratory projects like the Fourmile initiative. With continued strong performance expected moving forward, including a 30% rise in attributable EBITDA, Barrick Gold is poised to solidify its leadership position in the mining sector, making it an attractive prospect for investors looking for stability and growth in the gold and copper market.

Fourmile Project Update: Advancing Towards a Pre-Feasibility Study

The Fourmile project in Nevada is one of Barrick Gold’s most promising ventures this year, having recently transitioned into a pre-feasibility study (PFS) phase. After a successful drilling program that revealed an extensive resource base, this project is now on track to deliver a comprehensive economic assessment that could signal substantial growth potential. With resource grades showing improvement as exploration continues, Fourmile is being positioned as a world-class gold deposit, comparable to Barrick’s foundational Goldstrike asset.

CEO Mark Bristow noted the impressive economic indicators emerging from the preliminary assessments, stating that the current resources account for only one-third of the total orebody projected based on current drilling efforts. This statistic highlights the project’s capacity for future expansions and the significant role it will play in Barrick’s overall portfolio as they aim to sustain and ramp up production to further meet the rising demand for gold.

Compelling Economic Projections for Barrick’s Future

The economic projections surrounding the Fourmile project are enticing, particularly when considering the potential outcomes of the preliminary economic assessments. These studies indicate that Fourmile could evolve into a Tier One mine with mining rates and operational costs aligned with the current Goldrush mine plans. This positions Barrick Gold favorably within the competitive landscape, as the anticipated economic benefits from Fourmile could drive some of the highest returns in the industry.

Moreover, advancing through a rigorous three-year PFS program would ensure that Barrick Gold maintains its analytical and operational standards, which is critical for both accountability and future investment. As the initial drilling and assessments move forward, stakeholders can expect valuable insights that will further solidify Fourmile’s integrity as a cornerstone in Barrick’s long-term mining strategy.

Goldrush Mine Synergies: Leveraging Resources for Growth

The strategic evaluations of the Fourmile project will also focus on synergies with the existing Goldrush mine. According to Barrick executive Simon Bottoms, geotechnical drilling and favorable hydrological measurements have confirmed that Fourmile could offer lower permeability conditions than other Carlin-style deposits. This can significantly diminish dewatering requirements during development, which is vital for efficiency and cost management.

Additionally, the mine’s design incorporates three semi-independent production zones, enhancing operational flexibility and the potential for increased production rates. By integrating Fourmile’s infrastructure with Goldrush, Barrick Gold not only maximizes resource efficiency but also ensures that both projects can benefit from shared services and streamlined operations, potentially leading to higher profit margins in the long run.

Sustainable Value Creation: Barrick’s Commitment to Stakeholders

Barrick Gold’s commitment to sustainable value creation extends beyond just financial figures; it encompasses a holistic view that aims to benefit all stakeholders involved. CEO Mark Bristow has emphasized the company’s robust balance sheet and strong asset quality as critical components enabling Barrick to achieve its vision for growth. This forward-thinking approach not only reassures investors but also highlights the importance of sustainability in mining operations.

By focusing on organic growth projects, such as the Fourmile initiative, Barrick demonstrates its capability to create long-term value while responsibly managing environmental and social impacts. This balanced approach ensures that as Barrick Gold continues to explore new heights in gold and copper production, it also remains cognizant of its role in promoting sustainable practices that benefit local communities and the broader industry.

Investing in Barrick Gold: A Strategic Choice for Stakeholders

Investing in Barrick Gold represents a strategic choice for stakeholders looking to capitalize on the burgeoning commodities market. With impressive quarterly results underscored by a substantial increase in gold and copper production, Barrick stands out as a key player poised for future growth. The company’s ongoing projects, particularly in North America, are setting the stage for increased returns and long-term profitability.

Furthermore, as Barrick continues to advance projects like Fourmile, it is clear that the company is aligning itself with the future of sustainable mining practices. Stakeholders can take comfort in knowing that their investments are not only aimed at financial returns but also at fostering responsible mining that supports community development and environmental stewardship. This dual focus on profitability and responsibility positions Barrick Gold as a premier investment opportunity in the precious metals landscape.

Future Outlook: Barrick Gold’s Path Ahead

Looking ahead, Barrick Gold appears well-positioned to navigate the complexities of the mining industry, bolstered by its solid performance and proactive management strategies. The company’s plans to increase production and advance key projects such as Fourmile bode well for its future prospects. With sustained operational excellence and a clear commitment to growth, Barrick is preparing for a dynamic market environment.

Investors can anticipate ongoing developments that could further enhance Barrick’s competitive advantage, particularly as economic indicators remain favorable for gold and copper production. As the industry evolves, Barrick’s strategic positioning, diverse project pipeline, and commitment to sustainable practices will play a pivotal role in shaping its journey through the years ahead.

Navigating Industry Trends: Barrick’s Competitive Edge

In a constantly shifting mining landscape, Barrick Gold has demonstrated its adaptability and strong competitive edge. The company’s ability to meet production targets and expand its operational footprint highlights its competency in managing both short-term challenges and long-term opportunities. The strategic focus on key North American projects, complemented by significant gold and copper production increases, reinforces Barrick’s leading stance in the sector.

Moreover, as global demand for gold remains robust, Barrick is strategically positioned to respond to market fluctuations and seize opportunities for growth. By maintaining operational discipline and leveraging synergies across its mines, particularly through innovative projects like Fourmile, Barrick Gold ensures it remains at the forefront of industry advancements while delivering value to its shareholders.

Community Commitment: Barrick Gold’s Social Responsibility

Barrick Gold’s commitment to social responsibility is a fundamental aspect of its operational philosophy. The company aims to create positive impacts on the communities surrounding its operations, with initiatives that support education, health, and economic development. By fostering collaborative relationships with local stakeholders, Barrick does not just mine; it actively contributes to the betterment of societies where it operates.

As Barrick advances its projects, it is also dedicated to upholding environmental standards and minimizing the ecological footprint of its mining activities. This conscientious approach not only enables Barrick Gold to operate sustainably but also positions the company as a leader in corporate social responsibility within the mining industry, making it an attractive option for conscious investors who prioritize ethical practices.

Frequently Asked Questions

What were Barrick Gold’s Q4 results for 2024?

Barrick Gold’s Q4 results for 2024 showcased strong performance, with significant increases in both gold and copper production. The company reported a 15% rise in gold production and a 33% rise in copper production compared to Q3. Operating cash flow rose by 20% to US$4.49 billion, and free cash flow more than doubled to US$1.32 billion, highlighting Barrick Gold’s robust performance across its North American operations.

How has Barrick Gold’s North American operations contributed to its performance?

Barrick Gold’s North American operations have played a crucial role in the company’s performance by meeting production guidance for the year. This includes a 15% increase in gold production and a 33% rise in copper production. These results reflect the strength of Barrick’s operational capabilities and contribute significantly to its overall financial performance, particularly evidenced by a 69% rise in net earnings.

What updates do we have on the Fourmile project in relation to Barrick Gold’s performance?

The Fourmile project is a key growth initiative for Barrick Gold, as it has transitioned to a pre-feasibility study (PFS) following successful drilling in Nevada. This project promises substantial growth potential, positioning it as a world-class gold deposit. The preliminary economic assessment has shown favorable economic indicators, compelling Barrick to advance with further development plans, which are anticipated to enhance the company’s overall performance.

What are the economic projections for Barrick Gold’s Fourmile project?

The economic projections for Barrick Gold’s Fourmile project are highly favorable, suggesting it has the potential to evolve into a Tier One mine. Costs and mining rates are projected to be competitive, comparable to the existing Goldrush mine. The project is expected to contribute significantly to Barrick Gold’s future performance, with assessments indicating promising economic viability.

How did Barrick Gold’s earnings perform year-on-year?

Barrick Gold’s year-on-year earnings performance showed remarkable improvement, with net earnings rising by 69% to US$2.14 billion for the full year of 2024. Adjusted net earnings increased by 51% to US$2.21 billion, demonstrating the company’s effective strategies and operational efficiencies, particularly within its North American operations.

What synergies are anticipated from the Fourmile project and the Goldrush mine?

The Fourmile project is expected to create significant synergies with the Goldrush mine, particularly in materials handling and processing capabilities. Ongoing geotechnical assessments indicate that favorable ground conditions may reduce operational challenges and enhance production flexibility, ultimately benefiting Barrick Gold’s overall efficiency and performance,

What factors have driven the increase in Barrick Gold’s gold and copper production?

The increase in Barrick Gold’s gold and copper production can be attributed to effective operational strategies, successful drilling programs, and advances in ongoing projects like Fourmile. These efforts not only met but exceeded the company’s annual guidance, reflecting the strength of Barrick’s North American operations and its commitment to sustainable production.

| Key Point | Details |

|---|---|

| Strong Q4 Performance | Barrick Gold’s North American operations delivered impressive results, exceeding production guidance. |

| Operating Cash Flow Growth | Year-on-year operating cash flow increased by 20%, reaching US$4.49 billion. |

| Free Cash Flow | Free cash flow rose to US$1.32 billion, more than doubling from the previous year. |

| Significant Production Increases | Gold production up 15% and copper production up 33% compared to Q3. |

| Record Year-End Results | Full-year results included a 69% increase in net earnings to US$2.14 billion. |

| Fourmile Project Advancements | Transition to a Pre-Feasibility Study (PFS) following a successful drilling program. |

| Goldrush Mine Synergies | Evaluating synergies with the Goldrush mine, reducing dewatering requirements and increasing production potential. |

Summary

Barrick Gold performance demonstrates solid growth and strategic advancement in its North American operations, particularly in Q4, where the company exceeded production guidance across its divisions. With significant increases in both gold and copper production and impressive financial results, Barrick is well-positioned for future success. Their commitment to projects like Fourmile highlights ongoing efforts to innovate and extract value while aligning with sustainable growth practices.