BTC exchange inflow, representing the total amount of Bitcoin transferred to exchanges, has seen notable fluctuations in recent months. Following a peak of 98,748 BTC on November 25, 2024, there has been a significant decline in inflows, suggesting a reduction in selling pressure among investors. This trend is further corroborated by CryptoQuant data, which indicates that daily exchange inflows have varied from 11,000 to 79,000 BTC in December 2024. As the market adjusts, the interplay between BTC exchange inflow and Bitcoin miner outflow becomes crucial in understanding Bitcoin price analysis and broader Bitcoin exchange trends. The decline in miner outflows alongside decreased exchange inflows points to a potential stabilization in the Bitcoin trading volume, setting the stage for future market movements.

The movement of Bitcoin to trading platforms, often referred to as BTC exchange inflow, has been a key indicator of market sentiment and activity. Recent shifts in this metric reflect broader trends in Bitcoin liquidity and miner behavior, revealing insights into the market’s current health. As miners reduce their selling activity, it suggests that they are holding onto their assets rather than liquidating for immediate profit, which could influence future price dynamics. Meanwhile, fluctuations in Bitcoin trading volume and the recent data from CryptoQuant highlight a critical period of adjustment for investors and traders alike. Understanding these patterns is essential for anyone looking to navigate the ever-changing landscape of cryptocurrency investments.

Understanding BTC Exchange Inflow Trends

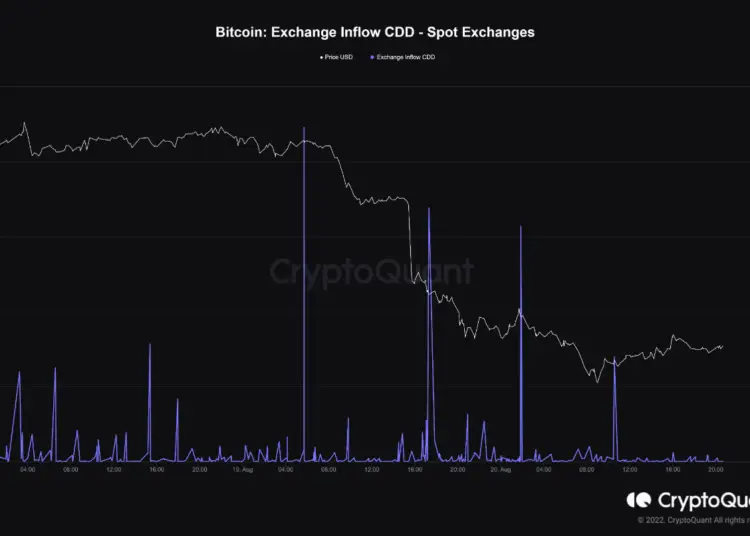

The BTC exchange inflow refers to the total amount of Bitcoin being transferred to exchanges for trading. Recent data from CryptoQuant indicates a notable trend: since November 2024, there has been a significant drop in exchange inflows. This decline is particularly interesting as it follows a peak inflow of 98,748 BTC on November 25, 2024. The heightened activity prior to this peak suggests that traders were actively selling off their holdings, possibly in response to Bitcoin’s historic price rally following the election results. However, as we moved into December 2024, inflows began to stabilize, fluctuating between 11,000 and 79,000 BTC per day, indicating a shift in market sentiment and possibly reduced selling pressure.

The correlation between BTC exchange inflow and the overall market dynamics cannot be overstated. A consistent inflow might suggest bullish sentiment, where traders anticipate price increases. Conversely, a drop in inflows typically indicates reduced selling pressure, which could lead to price stabilization or even an upward trend. As we analyze the BTC exchange inflow data, it’s essential to also consider the Bitcoin miner outflow, which has seen a similar decline. This suggests that miners, who traditionally offload BTC to cover costs, might be holding onto their assets, contributing to a more bullish outlook in the market.

The Impact of Bitcoin Miner Outflow on Market Dynamics

Bitcoin miner outflow has been a critical indicator of market health, particularly since the highs observed in November 2024. During this period, miners took advantage of the soaring prices, sending 25,367 BTC to exchanges as Bitcoin hit approximately $88,000. This was a strategic move to secure profits amid a historic rally. However, as we transitioned into January 2025, the outflow from miners has significantly decreased, with only 5,489 BTC sent to exchanges on January 1 and even lower amounts in the subsequent days. This decrease might suggest that miners are now more cautious and choosing to hold onto their assets, potentially anticipating further price increases.

The reduction in miner outflow is particularly relevant in the context of Bitcoin’s trading volume and price analysis. Analysts have pointed out that for Bitcoin to break past certain resistance levels, an increase in daily trading volume is essential. The current low miner outflow could contribute to a tightening supply, which, combined with increased demand as seen in recent ETF inflows, may create a conducive environment for a price surge. Thus, monitoring miner outflow alongside trading volume trends will be crucial for understanding future price movements.

Bitcoin Price Analysis Amidst Changing Exchange Trends

In the context of recent exchange trends, Bitcoin’s price analysis reveals a complex interplay between inflows, outflows, and overall market sentiment. Following the substantial inflows and subsequent declines, analysts from Bitfinex expect Bitcoin to trade between $95,000 and $110,000 in January 2025. This cautious optimism stems from the notion that the market structure remains bullish, despite the lack of sufficient trading volume to trigger a significant upward move. Price movements will largely depend on how traders react to these exchange trends, as well as external economic factors influencing the crypto market.

Moreover, the analysis of Bitcoin’s price movements must also consider the broader implications of reduced miner outflows. As miners hold onto their assets, it suggests a tightening supply, which could lead to upward pressure on prices if demand remains strong. Additionally, the rebound of inflows into Bitcoin exchange-traded funds—amounting to $900 million on January 3, 2025—indicates renewed interest from institutional investors. This trend could play a pivotal role in shaping Bitcoin’s price trajectory, particularly if trading volume begins to rise alongside these inflows.

Analyzing Bitcoin Exchange Trends with CryptoQuant Data

CryptoQuant data offers invaluable insights into Bitcoin exchange trends, particularly regarding inflow and outflow metrics. The data indicates that the significant inflow of BTC in November 2024 was a reaction to heightened trading activity, which was subsequently followed by a decline in December. This shift in inflow patterns is critical for understanding trader behavior and market dynamics. It suggests that while the initial surge in trading may have been motivated by profit-taking, the subsequent decline points to a more cautious approach among investors, likely influenced by market volatility.

Furthermore, the analysis of exchange trends through CryptoQuant not only highlights inflow and outflow statistics but also provides context for Bitcoin’s overall trading volume. As the exchange inflows decrease, the implications for trading volume become apparent. A sustained drop in inflows typically results in lower trading activity, potentially signaling a consolidation phase in the market. For traders and investors, understanding these trends is crucial for making informed decisions, especially in a market characterized by rapid price fluctuations and external economic pressures.

The Role of Bitcoin Trading Volume in Market Movements

Trading volume is a pivotal metric in the cryptocurrency market, influencing price movements and market sentiment. In the case of Bitcoin, the recent analysis suggests that for the cryptocurrency to overcome its current resistance levels, a significant increase in daily trading volume is necessary. Analysts, including Axel Adler, have emphasized the bullish market structure but highlighted the lack of sufficient trading volume as a barrier to achieving a strong price impulse. This underscores the importance of monitoring trading activity as it provides context for potential price movements.

Additionally, the trading volume often reflects the level of interest from both retail and institutional investors. Recent trends indicate a rebound in institutional investments, as evidenced by the $900 million inflow into Bitcoin ETFs on January 3, 2025. This renewed interest could potentially enhance trading volume, leading to a more vibrant market. Therefore, analyzing trading volume in conjunction with BTC exchange inflows and miner outflows will be essential for predicting future price trends and understanding the overall market landscape.

The Significance of Bitcoin ETF Inflows and Outflows

The inflow and outflow trends of Bitcoin exchange-traded funds (ETFs) play a significant role in the broader cryptocurrency market. The recent $900 million inflow into Bitcoin ETFs on January 3, 2025, marks a notable rebound from previous days of significant outflows. This reversal not only reflects renewed interest from traditional finance but also highlights the growing acceptance of Bitcoin as a legitimate investment vehicle. Institutional investors are often seen as key drivers of market stability and growth, and their renewed engagement through ETFs could provide a much-needed boost to Bitcoin’s trading volume.

Understanding the dynamics of ETF inflows and outflows is crucial for market participants. A consistent inflow into Bitcoin ETFs suggests positive sentiment and potentially higher demand for Bitcoin, which can lead to increased prices. Conversely, significant outflows may indicate a lack of confidence in the market or a shift in investment strategies. As such, monitoring these trends alongside BTC exchange inflow and miner outflow data can provide valuable insights into market health and future price movements.

Bitcoin Market Sentiment and Future Outlook

Market sentiment plays a crucial role in shaping Bitcoin’s price movements and overall investor behavior. The current landscape, characterized by a decrease in BTC exchange inflows and miner outflows, suggests a cautious yet optimistic sentiment among traders. With analysts predicting a trading range between $95,000 and $110,000 for January 2025, it is evident that the market is in a consolidation phase, awaiting further developments in trading volume and investor activity. As the market recovers from the holiday season, the sentiment could shift rapidly, influencing trading strategies and price trajectories.

Furthermore, as Bitcoin navigates through these trends, external factors such as regulatory changes, macroeconomic conditions, and technological advancements will also influence market sentiment. The recent uptick in ETF inflows is a positive indicator, signaling that institutional investors are still interested in Bitcoin despite previous volatility. As the market continues to evolve, understanding how these sentiment dynamics interact with BTC exchange inflows and outflows will be critical for investors looking to capitalize on future opportunities.

The Interplay Between BTC Exchange Inflow and Market Trends

The interplay between BTC exchange inflow and broader market trends is an essential aspect of understanding cryptocurrency dynamics. The data from CryptoQuant shows a marked decrease in BTC exchange inflow since the peak in November 2024. This shift signals a change in trader behavior, with a potential pivot towards holding assets rather than liquidating them for immediate gains. This trend is further supported by the decline in miner outflows, suggesting that miners are also choosing to retain their BTC, anticipating further price appreciation.

This interplay is critical, as it shapes the supply-demand equation within the market. Reduced inflows and outflows could lead to a more stable price environment, where volatility is minimized, and price appreciation becomes more feasible. As traders and investors monitor these dynamics, it becomes increasingly important to keep an eye on how these trends evolve in relation to Bitcoin’s trading volume and market sentiment. Understanding this interplay will be pivotal for informed decision-making in the ever-evolving cryptocurrency landscape.

Future Considerations for Bitcoin Investors

As Bitcoin continues to navigate a volatile market landscape, investors must remain vigilant and informed about ongoing trends. The recent decline in BTC exchange inflows, coupled with reduced miner outflows, suggests a potential shift in market dynamics that could lead to price stabilization. However, the lack of sufficient trading volume presents a challenge for Bitcoin to achieve any significant upward movement. Investors should consider these factors when developing their strategies and remain aware of external influences that could impact market behavior.

Looking ahead, the engagement of institutional investors through Bitcoin ETFs will be a crucial factor to monitor. The recent $900 million inflow indicates a renewed interest that could bolster trading volume and market sentiment. For investors, understanding the implications of these trends, along with the interplay between BTC exchange inflow and miner outflow, will be essential for capitalizing on future opportunities in the cryptocurrency market. By staying informed and adapting to these changes, investors can better position themselves for success in an increasingly competitive and dynamic environment.

Frequently Asked Questions

What does BTC exchange inflow indicate about market trends?

BTC exchange inflow measures the total amount of Bitcoin transferred to exchanges, serving as a key indicator of market trends. A significant increase in inflow often suggests heightened selling pressure, while a decrease, such as the drop observed since November 2024, indicates reduced selling activity and potentially bullish market sentiment.

How did Bitcoin miner outflow affect BTC exchange inflow in late 2024?

In late 2024, as BTC exchange inflow peaked at 98,748 BTC, Bitcoin miner outflow also began to decline. This trend suggests that miners were less inclined to sell their assets, contributing to lower pressure on BTC prices and signaling a potential shift towards bullish market conditions.

What insights can CryptoQuant data provide about Bitcoin exchange trends?

CryptoQuant data reveals significant insights into Bitcoin exchange trends, particularly regarding BTC exchange inflow and miner outflow. For instance, the data highlighted a peak in BTC inflow in November 2024, alongside a notable decrease in miner outflow, indicating a balance between market supply and demand.

How does BTC trading volume relate to BTC exchange inflow?

BTC trading volume is closely linked to BTC exchange inflow, as higher volumes typically accompany increased inflows. Analysts suggest that for Bitcoin to break resistance levels, there needs to be a sustained increase in daily trading volume, which directly correlates with BTC exchange inflow dynamics.

What factors contributed to the recent decline in BTC exchange inflow?

The decline in BTC exchange inflow since November 2024 can be attributed to several factors, including reduced selling pressure from Bitcoin miners and a general market sentiment shift. As miners decreased their outflows, the overall amount of Bitcoin sent to exchanges also fell, reflecting a potential accumulation phase.

Why is monitoring BTC exchange inflow important for investors?

Monitoring BTC exchange inflow is crucial for investors as it provides insights into market sentiment and potential price movements. A decrease in inflow may indicate a bullish trend, while an increase can signal selling pressure, helping investors make informed trading decisions based on real-time data.

What impact do Bitcoin exchange-traded funds (ETFs) have on BTC exchange inflow?

Bitcoin exchange-traded funds (ETFs) can significantly impact BTC exchange inflow by attracting institutional investors. Recent data showing $900 million in inflows into Bitcoin ETFs suggests renewed interest, which can lead to increased BTC exchange inflow as institutional buying pressure rises.

| Key Point | Details |

|---|---|

| BTC Exchange Inflow | The total amount of BTC transferred to exchanges has significantly dropped since November 2024, indicating reduced selling pressure. |

| Peak Inflows | On November 25, 2024, inflows peaked at 98,748 BTC after two months of heightened activity. |

| December 2024 Activity | Inflows declined but remained between 11,000 and 79,000 BTC per day. |

| Miner Outflow Trends | Miner outflows also decreased, suggesting miners are less willing to sell BTC. |

| Outflow Peaks | Miner outflows peaked on November 11, 2024, at 25,367 BTC, coinciding with Bitcoin’s price hitting $88,000. |

| Future Price Expectations | Analysts predict Bitcoin will trade between $95,000 and $110,000 in January 2025, but require increased trading volume to break resistance. |

| ETF Inflows | Inflows into Bitcoin ETFs rebounded, with $900 million on January 3, 2025, indicating renewed interest from traditional finance. |

Summary

BTC exchange inflow has witnessed a notable decline since the peak in November 2024, reflecting a shift in market dynamics and reduced selling pressure from miners. As Bitcoin trades between $95,000 and $110,000, the decrease in inflows suggests that both retail and institutional investors are currently adopting a more cautious approach. The recent rebound in ETF inflows further indicates growing interest in Bitcoin among traditional finance, highlighting potential for future market recovery. Overall, monitoring BTC exchange inflow trends will be crucial for understanding the market’s direction in the coming months.