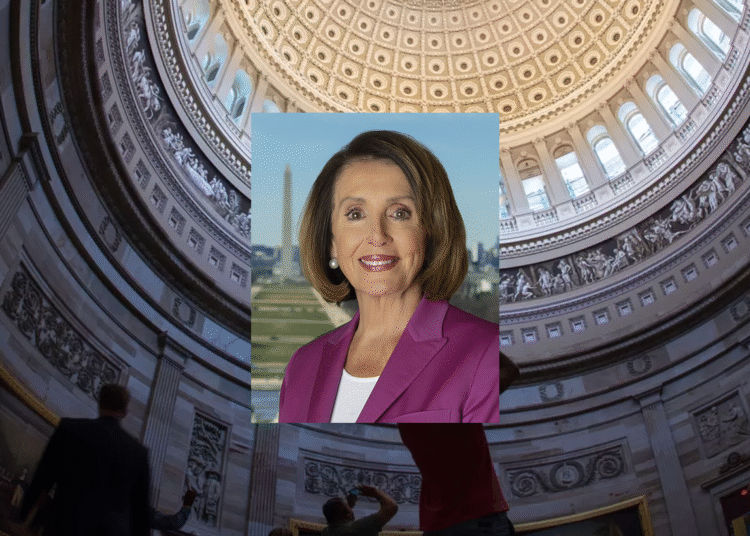

The Congressional Stock Trading Ban has become a hot topic in political discourse, driven in large part by Senator Elizabeth Warren’s recent calls for an outright prohibition on such practices among lawmakers. In her impassioned plea, Warren addressed the inherent ethical quandaries that arise when representatives have access to insider trading information that could sway their financial decisions. She insists that voters deserve assurance that their elected officials prioritize the American public over personal profit, especially within discussions of market-sensitive legislation. This proposed ban not only targets congressional members but extends to the President and Vice President, aiming to level the playing field of ethical stock trading. As the debate intensifies, even notable figures like Representative Nancy Pelosi, widely associated with the controversial Pelosi Act, have begun to advocate for reforms, highlighting the urgent need for transparency in Congress regarding stock trades.

The notion of banning stock trading among members of Congress has gained traction as a pivotal part of the conversation about ethical governance. Increasing attention to insider trading within legislative bodies raises significant questions about transparency and accountability for those in power. With lawmakers like Elizabeth Warren championing this initiative, the focus has shifted towards ensuring that political decisions are made with the public’s best interest at heart, rather than personal financial gain. Recent shifts, including endorsements from influential figures such as Nancy Pelosi, suggest a growing consensus on the need to regulate congressional financial activities under what some are now calling the Congressional Trading Reform. This movement aims to dismantle practices that allow elected officials to profit from privileged information, ultimately striving to restore trust in government.

The Ethical Dilemma of Congressional Stock Trading

Members of Congress often hold positions that grant them access to sensitive information which can substantially sway stock prices. This access raises significant ethical concerns regarding their participation in stock trading. When lawmakers trade stocks based on information acquired through their unique positions, it leads to a troubling perception of insider trading, where decisions may be influenced more by personal financial gain than by public interest. Senator Elizabeth Warren has been a staunch advocate for confronting these ethical dilemmas, positing that such practices can shake public trust in government representatives.

Warren highlights that legislators need to prioritize transparency and integrity over personal financial interests. The call for a ban on Congressional stock trading aligns with a growing trend aimed at enhancing ethical standards in governance. By eliminating the potential for conflicts of interest inherent in insider trading among Congress members, legislation like the proposed ban can help restore confidence in governmental decision-making and ensure that elected officials are acting in the best interest of their constituents rather than their own wallets.

The Implications of the Proposed Congressional Stock Trading Ban

The proposed Congressional Stock Trading Ban seeks to prohibit all elected officials, including the Presidency and Vice Presidency, from trading individual stocks. This legislation, championed by Warren and recently endorsed by Nancy Pelosi, would mark a significant shift in how Congress operates regarding stock market activities. It aims to establish clear boundaries between public service and personal financial pursuits, thereby reinforcing the principle that legislators should prioritize their responsibilities over economic interests.

If enacted, the ban would likewise deter lawmakers from abusing their access to insider information for personal gain. It aligns with efforts to enhance ethical conduct in Congress, ensuring decisions are made for the collective good rather than by temptation of profit. Such measures are crucial for upholding a fair and equitable system, effectively disentangling lawmaking from potential monetary motivations that compromise integrity, creating a more trustworthy legislative environment.

Citizen Reactions to Congressional Stock Trading Practices

Public sentiment regarding Congressional stock trading has evolved significantly in recent years, driven by increased awareness of the potential for insider trading among lawmakers. Citizens are becoming more vocal about their expectations for ethical governance and transparency, as seen in the recent discussions around the Pelosi Act. Many constituents express concern that their representatives may prioritize personal financial gain over their duties to serve the public, which feeds into calls for reform.

As more constituents call for accountability, elected officials must navigate these concerns carefully to maintain public trust. The groundswell of support for legislative actions like the Congressional Stock Trading Ban reflects a desire for a political landscape in which ethical standards are upheld and the integrity of governance is restored. Citizens want assurance that when lawmakers make decisions, those choices are rooted in the well-being of the community rather than financial self-interest.

The Role of the PELOSI Act in Congressional Reforms

The PELOSI Act, named after former Speaker Nancy Pelosi, has been under scrutiny for its implications concerning stock trading among Congress members. Originally labeled a critique of perceived unethical stock trading, the act has evolved into a pivotal piece of legislation supporting sweeping changes in how elected officials approach personal investments. Its potential passage symbolizes a broader movement toward transparency and ethical governance in an era where public trust has waned.

While Pelosi’s endorsement of the ban may seem ironic given past criticisms of her family’s stock trades, her support signals a readiness in Congress to tackle ethical issues that have long plagued its operations. The PELOSI Act has ignited vital conversations about how Congress can move forward to ensure that public servants are held to the highest moral standards, which can help restore the public’s faith in elected officials and the legislative process as a whole.

Elizabeth Warren’s Push for Legislative Change

Senator Elizabeth Warren has emerged as one of the leading voices advocating for reform regarding stock trading by Congress members. With her recent statements emphasizing the ethical concerns linked to insider trading, Warren has made it her mission to ensure that elected officials are held to rigorous ethical standards that prevent conflicts of interest. Her commitment to instituting a ban reflects the growing demand for accountability in governance.

Warren’s vocal advocacy is instrumental in bringing attention to the need for substantial change in congressional practices. By advancing discussions surrounding the Congressional Stock Trading Ban, she aims to inspire a broader movement that compels lawmakers to evaluate their responsibilities and the ethical implications of their financial activities. This not only addresses immediate concerns about insider trading but lays the groundwork for long-term reforms aimed at enhancing public trust in government.

Understanding Insider Trading in Congressional Contexts

Insider trading is a term that conjures images of unethical corporate practices that can lead to severe legal repercussions. In a Congressional context, however, the stakes are different, as lawmakers possess abilities to influence market-sensitive information that can lead to conflicts of interest. This practice leads to not just ethical concerns, but questions about the very integrity of the legislative processes. For many citizens, insider trading by Congress underscores a system that can appear rigged, overshadowing the democratic values of fairness and justice.

This distinction is critical in discussions led by figures like Elizabeth Warren, who are pushing for a ban on Congressional stock trading to separate financial motives from legislative responsibilities. The implication is clear: if lawmakers are privy to information that could be used to benefit their own stock trades, the trust bid between the public and their elected officials diminishes. Therefore, addressing insider trading requires not only legal reform but also a reevaluation of the ethical frameworks guiding legislative behavior.

Navigating the Political Landscape of Stock Trading

The political landscape surrounding Congressional stock trading is complex, often fraught with contention and public backlash. With the spotlight now firmly on the ethical ramifications of members trading stocks, lawmakers find themselves at a crossroads between personal financial ambitions and public expectations for accountability. The push for legislation, like the Congressional Stock Trading Ban, articulates a broader narrative that prioritizes ethical governance while balancing political power.

Navigating this political landscape requires astute awareness by elected officials, as they must consider how their financial choices may reflect on their governance. As more politicians engage in conversations about reform, it can potentially reshape the dynamics of power and the ethical narrative in Congress. The hope is that by addressing stock trading practices, Congress can reinforce its commitment to serving the public interest above all else, rather than being perceived as self-serving.

Building Public Trust Through Ethical Reforms

Building and maintaining public trust is a fundamental aspect of any democratic government, and addressing unethical practices like Congressional stock trading is critical in retaining that trust. With citizens increasingly wary of potential conflicts of interest among their representatives, calls for stringent laws governing stock trades have gained momentum. Senator Warren’s advocacy for the Congressional Stock Trading Ban signifies a proactive step toward ensuring public officials align their actions with the expectations of accountability and transparency.

Implementing effective reforms can foster an environment where public confidence is restored. When Congress demonstrates a commitment to ethical conduct, it echoes the values of integrity and responsibility that the electorate desires. The reforms proposed, including the Congressional Stock Trading Ban, may serve to empower citizens, reassuring them that their representatives are focused on the nation’s best interests and not merely their financial portfolios.

The Future of Ethical Standards in Congress

The future of ethical standards in Congress is increasingly being shaped by the discussions surrounding the ban on stock trading by elected officials. The advocacy led by figures such as Elizabeth Warren suggests a paradigm shift towards stricter governance practices that prioritize transparency and ethical conduct. These reforms signify a recognition that the integrity of Congress is paramount in ensuring that public officials can serve effectively without the overshadowing influence of personal gain.

As conversations continue around these critical issues, the hope is that future legislative changes will not only prohibit unethical practices but also cultivate a new norm within Congress focused on ethical engagement and legislative integrity. This shift may ultimately encourage lawmakers to foster deeper connections with their constituents through a renewed commitment to public service, positioning Congress as a body truly committed to its ethical responsibilities.

Frequently Asked Questions

What is the Congressional Stock Trading Ban proposed by Elizabeth Warren?

The Congressional Stock Trading Ban, championed by Senator Elizabeth Warren, aims to prevent members of Congress, including the President and Vice President, from trading individual stocks. It seeks to eliminate potential conflicts of interest and ensure that elected officials make decisions based on public welfare rather than personal financial gain.

Why is Elizabeth Warren advocating for a ban on Congressional stock trades?

Elizabeth Warren advocates for a ban on Congressional stock trades due to concerns over insider trading in Congress. She emphasizes that lawmakers have unique access to sensitive market information and the power to influence legislation that can affect stock prices, which poses ethical risks and undermines public trust.

What are the ethical implications of Congressional stock trading?

The ethical implications of Congressional stock trading include the risk of insider trading, where lawmakers could leverage privileged information to benefit personally. This practice raises questions about the integrity of decision-making processes and the potential prioritization of personal interests over public service.

How does the proposed ban relate to the Pelosi Act?

The proposed Congressional Stock Trading Ban has drawn comparisons to the Pelosi Act, which refers to how the financial success of Nancy Pelosi’s family became synonymous with Congressional stock trading. The act seeks to restore trust in government by preventing any member of Congress from undertaking stock trades that may conflict with their legislative responsibilities.

What would the Congressional Stock Trading Ban entail?

The Congressional Stock Trading Ban would prohibit all elected officials, including the President and Vice President, from trading individual stocks. The bill includes provisions to outline implementation details and timing, with the fundamental goal of enhancing ethical standards among public officials.

Have any other Congress members supported the Congressional Stock Trading Ban?

Yes, several members of Congress, including Representative Nancy Pelosi, have expressed support for the Congressional Stock Trading Ban. Pelosi’s endorsement is noteworthy given the historical context of her family’s stock trading success, and she emphasizes the importance of ethical conduct in governance.

How would the Congressional Stock Trading Ban affect lawmakers’ decision-making?

The Congressional Stock Trading Ban aims to eliminate potential conflicts that can arise from lawmakers trading stocks based on insider information. This would encourage lawmakers to focus solely on public well-being without the distraction or temptation of personal financial investments.

What is the current status of the Congressional Stock Trading Ban legislation?

As of now, the Congressional Stock Trading Ban is proposed legislation and is being discussed among lawmakers. The next steps would involve formal debates, potential modifications, and voting to determine its passage.

| Key Points | Details |

|---|---|

| Elizabeth Warren’s Advocacy | Senator Warren calls for a ban on Congressional stock trading, citing ethical concerns. |

| Insider Information | Warren highlights that members of Congress have access to sensitive information that can affect stock markets. |

| Legislation Details | Proposed bill seeks to prohibit all elected officials from trading individual stocks. |

| Support from Nancy Pelosi | Pelosi endorses the bill despite its previous association with her family’s stock trades. |

| Public Trust | Warren and Pelosi emphasize the need for ethical standards to restore trust in government. |

Summary

The Congressional Stock Trading Ban is a significant legislative effort aimed at curbing unethical stock trading practices among elected officials. Senator Elizabeth Warren advocates for this ban to prevent lawmakers from using insider information for personal financial gain, arguing that it undermines public trust in government. The support from fellow lawmakers, including Nancy Pelosi, indicates a growing consensus on the need to enhance ethical standards in Congress. This proposed legislation seeks to ensure that decisions made by elected officials are in the best interest of the country, not just for their financial benefit.