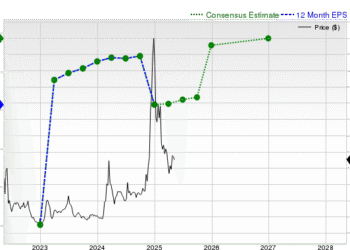

As we look ahead to the copper market 2025, analysts are optimistic about a notable resurgence in both demand and production. With recent trends showing copper futures trading at approximately US$4.14 per pound, the market is poised for growth, driven by expectations of increased industrial activity and potential stimulus measures from China. Major players like BHP Group and Rio Tinto are ramping up their copper production plans, responding to the rising copper demand forecasted for the coming years. This bullish outlook is bolstered by the ongoing expansion of the global copper industry, which has seen a remarkable 300% increase in refined copper usage over the last fifty years. As urbanization and infrastructure projects continue to drive the need for copper, investors are keenly watching the copper price forecast to capitalize on emerging opportunities in this dynamic market.

In the context of the upcoming copper market in 2025, industry experts are predicting a significant uplift in both production and consumption of this essential metal. The landscape of copper trading is shifting, with futures prices suggesting a healthy rebound influenced by global economic conditions and industrial growth. Key stakeholders in the copper sector, including leading mining companies, are gearing up to meet the surging demand driven by advancements in technology and infrastructure development. As the market dynamics evolve, the copper production landscape will likely reflect these trends, emphasizing the importance of copper in sectors ranging from construction to electronics. The anticipated growth in the copper industry in 2025 aligns with broader economic themes, presenting a compelling case for investors and stakeholders alike.

The Copper Market Outlook for 2025

As we look toward 2025, the copper market is poised for a significant resurgence, driven by numerous factors including increased production and robust demand. Analysts predict that with prices currently stabilizing around US$4.14 per pound, the market is on the brink of a major comeback. This optimism is largely attributed to the anticipated stimulus measures from the Chinese government, which could further bolster manufacturing activities and, consequently, copper demand. With the global economy gradually recovering, the copper industry is set to benefit from traditional sectors like construction and emerging technologies.

Moreover, the production forecasts from major mining companies like BHP Group and Rio Tinto highlight a commitment to increasing copper output, which is essential for meeting the projected demand in 2025. BHP’s expectation of a 4% increase in copper volumes correlates with the rising global appetite for this essential metal. The ongoing expansion of infrastructure projects in various regions, particularly in Asia-Pacific, is expected to elevate copper demand, reinforcing its position as a critical commodity in the global market.

Frequently Asked Questions

What is the copper market forecast for 2025?

The copper market forecast for 2025 indicates significant growth, with analysts predicting that increased production and rising demand will drive prices higher. Major mining companies like BHP and Rio Tinto are planning to ramp up copper production, which is expected to support price stability and potentially increase copper futures.

How will copper production impact the copper market in 2025?

Copper production is set to have a positive impact on the copper market in 2025. Companies like BHP, which reported a 9% growth in copper volumes, are expecting further increases. This trend, coupled with rising global demand, is likely to enhance the market’s overall performance and stability.

What factors will drive copper demand in 2025?

In 2025, copper demand will be driven by urbanization, industrialization, and the growth of sectors such as construction and electronics. The increasing use of copper in electric vehicles and renewable energy projects will also contribute significantly to the rising demand for copper in the coming years.

What is the expected copper price forecast for 2025?

The copper price forecast for 2025 is optimistic, with analysts noting a potential increase in prices due to heightened demand and production growth. Current trends suggest that copper futures may stabilize around US$4.14 per pound, but projections vary based on economic conditions and market dynamics.

Why is the copper industry important in 2025?

The copper industry is crucial in 2025 due to its role in supporting infrastructure development, manufacturing, and technological advancements. With a projected market value growth to approximately $572 billion by 2030, copper remains essential for various applications, including construction, electronics, and electrical systems.

What role does China play in the copper market by 2025?

By 2025, China is expected to continue playing a dominant role in the copper market, accounting for a significant portion of global demand. As the largest automobile manufacturing country, China’s growth in electric vehicles and industrial production will be key drivers of increased copper consumption.

How is the copper market evolving with technological advancements by 2025?

The copper market is evolving rapidly due to technological advancements that enhance copper’s applications, particularly in the electrical and telecommunications sectors. Innovations in these fields are driving up demand for refined copper, which is projected to grow significantly by 2025.

What are the key trends influencing the copper market in 2025?

Key trends influencing the copper market in 2025 include increased production capacity from major miners, rising demand driven by urbanization and technological advancements, and a growing focus on renewable energy and electric vehicles, which require substantial copper resources.

| Key Point | Details |

|---|---|

| Copper Prices | Prices rebounded to around US$4.14 per pound, nearing a three-week high. |

| Market Growth | Estimated copper market value was $417 billion in 2024, projected to grow to $572 billion by 2030. |

| Major Producers | BHP and Rio Tinto plan to increase production, with BHP expecting a 4% growth in FY25. |

| Chinese Demand | Chinese manufacturing activity expanded, indicating strong demand for copper. |

| Recycling Impact | Copper is highly recycled, contributing to the growth of the secondary copper market. |

| Regional Market Share | Asia-Pacific holds a 41% market share and shows the fastest growth potential. |

Summary

The copper market 2025 is set to experience significant growth, driven by increasing prices, higher production from major mining companies, and robust demand from China and other regions. Analysts predict that with a projected market value growth from $417 billion in 2024 to approximately $572 billion by 2030, copper will remain a critical component in construction and technological advancements. This optimistic outlook is supported by the ongoing urbanization and industrialization trends, positioning copper as an essential material for future developments.