Dayforce stock surge has captured the attention of investors as shares soared by 21.4% in pre-market trading, reaching an impressive $64.30. This remarkable uptick follows reports that Thoma Bravo, a notable private equity firm, is in discussions to acquire Dayforce Inc., igniting excitement about the company’s future. As the stock market movements evolve, other companies in pre-market trading are also showcasing significant fluctuations, such as Propanc Biopharma, which experienced a staggering 253% rise after a public offering announcement. Investors are closely monitoring these developments, particularly in light of the ongoing dynamics surrounding acquisition news. With enthusiasm building around Dayforce, it’s an opportune moment for stakeholders to evaluate their positions in the rapidly changing landscape of the stock market.

The recent ascension of Dayforce’s stock prices has stirred considerable interest in the financial sector. Shares have experienced a notable increase amid acquisition talks involving the renowned private equity firm, Thoma Bravo. This rising trend is not isolated, as other stocks are witnessing notable changes in pre-market trading, indicating a volatile but engaging atmosphere in the markets. Investors are particularly focused on such stock movements as they assess the implications of these developments, particularly in relation to news about significant acquisitions. As Dayforce’s performance shines, a broader analysis of related stocks like Propanc Biopharma reveals the interconnectedness of market reactions and investor sentiment.

Dayforce Stock Surge and Market Reactions

Dayforce stock has seen a remarkable surge in pre-market trading, climbing an impressive 21.4%, now priced at $64.30. This significant increase can be primarily attributed to the latest acquisition news regarding Thoma Bravo, a well-known private equity firm that is reportedly in negotiations to acquire Dayforce Inc. The market’s positive response to this potential acquisition reflects investors’ confidence in Thoma Bravo’s track record of enhancing the value of the companies it acquires.

As investors navigate stock market movements, the news of Thoma Bravo’s interest in Dayforce has generated substantial buzz. Such acquisitions often lead to improved operational efficiencies and greater market reach, which can substantially benefit shareholders. This surge in Dayforce stocks sets a bullish tone, and as more details about the acquisition discussions emerge, it could drive further trading interest in the stocks, reaffirming the significant role of strategic mergers and acquisitions in the market.

Frequently Asked Questions

What caused the Dayforce stock surge in pre-market trading?

The Dayforce stock surge, which saw shares increase by 21.4% to $64.30, was primarily driven by reports of Thoma Bravo’s interest in acquiring Dayforce Inc. This acquisition news has sparked investor enthusiasm, leading to significant gains during pre-market trading.

How does the Thoma Bravo acquisition news impact Dayforce stock surge?

The Thoma Bravo acquisition news has a positive effect on Dayforce, resulting in a substantial stock surge. As investors react to the prospect of the private equity firm’s acquisition, Dayforce shares rose sharply, reflecting heightened market confidence in the company’s future outlook.

What are the stock market movements related to Dayforce acquisition news?

The stock market movements related to Dayforce acquisition news have been notable, with Dayforce shares surging 21.4% in pre-market trading. Other stocks such as Propanc Biopharma also saw extreme movements, climbing 253%, indicating a generally active and volatile trading environment influenced by acquisition news.

Why did Dayforce shares rise 21.4% recently?

Dayforce shares rose 21.4% due to acquisition news from Thoma Bravo, a private equity firm. This speculation has prompted positive investor reactions, driving the stock price to $64.30 in pre-market trading.

What is the significance of pre-market trading for Dayforce stock?

Pre-market trading is significant for Dayforce stock as it reflects investor sentiment ahead of the regular trading session. The recent surge of 21.4% to $64.30 indicates strong market interest, likely influenced by acquisition discussions with Thoma Bravo.

Which companies had notable pre-market trading movements alongside Dayforce?

In addition to Dayforce, notable pre-market trading movements included Propanc Biopharma with a 253% increase, Adaptimmune Therapeutics up by 70.3%, and DIH Holding rising by 43.4%. These movements illustrate a broader trend of volatility in the stock market.

What does the stock surge in Dayforce suggest about investor confidence?

The stock surge in Dayforce, particularly a 21.4% rise amidst acquisition talks with Thoma Bravo, suggests heightened investor confidence in the company’s future prospects and the potential value of the acquisition.

How might the Dayforce stock surge affect its future performance?

The Dayforce stock surge, fueled by Thoma Bravo’s acquisition interest, may lead to increased liquidity and buying interest, potentially boosting future performance as investor optimism increases. Such movements often attract further attention from traders and analysts.

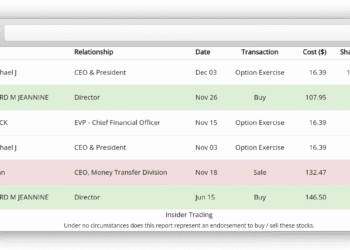

| Company | Stock Price | Percentage Change | Key Events |

|---|---|---|---|

| Dayforce Inc | $64.30 | +21.4% | Acquisition talks with Thoma Bravo. |

| Propanc Biopharma | $10.14 | +253% | Public offering priced at $4/share. |

| Adaptimmune Therapeutics | $0.1013 | +70.3% | Positive quarterly results. |

| DIH Holding | $0.3446 | +43.4% | No specific events reported. |

| Ryvyl Inc | $0.3846 | +33.3% | Retirement of chairman announced. |

| TPI Composites | $0.1150 | -51.1% | No specific events reported. |

Summary

The Dayforce stock surge, which saw shares increase by 21.4% to $64.30, highlights the company’s potential growth following acquisition talks with Thoma Bravo. This upward movement in the stock market, alongside significant gains in other companies like Propanc Biopharma and Adaptimmune Therapeutics, reflects a dynamic environment where investor sentiment can quickly shift based on news and financial performance. Overall, the market’s reaction indicates a mixed landscape, with some companies flourishing while others, like TPI Composites, faced declines.