Dogecoin’s price has whipsawed on Elon Musk’s tweets for years, but the latest catalyst isn’t a meme—it’s a plan to institutionalize the Shiba-themed token. Sources say Musk’s longtime attorney Alex Spiro will chair a publicly traded company that aims to raise $200 million to buy and hold Dogecoin on its balance sheet. Backed by the House of Doge, the official corporate entity launched in 2025 to steward the project, the vehicle could make DOGE accessible to mainstream investors the way MicroStrategy unlocked stock-market exposure to Bitcoin. Below, we unpack what this means, how investors might benefit, and the key risks to watch.

Table of Contents

- Understanding the $200 Million Dogecoin Treasury Company

- How Investors Could Benefit from a Public DOGE Treasury

- Risks, Red Flags, and Practical Safeguards

- Conclusion: A High-Beta Bet on Dogecoin’s Next Chapter

Understanding the $200 Million Dogecoin Treasury Company

What is a crypto treasury company?

A crypto treasury company is a public firm that treats a digital asset as its core reserve, raising capital in equity or debt markets to accumulate that asset and letting shareholders ride the price swings through ordinary stock accounts. MicroStrategy pioneered the model with Bitcoin in 2020 and now holds more than 791,000 BTC worth roughly $72 billion. The strategy has proliferated: 184 public companies have announced crypto purchases totaling almost $132 billion since January 2025.

Where does Dogecoin fit in?

The proposed DOGE vehicle—endorsed by the House of Doge and chaired by Spiro—follows similar logic. Investor decks viewed by Fortune list Spiro as chairman and target a $200 million raise to accumulate Dogecoin exclusively. If successful, it would join Bit Origin Ltd., which in July 2025 became the first Nasdaq firm to make DOGE its core asset after lining up as much as $500 million for purchases.

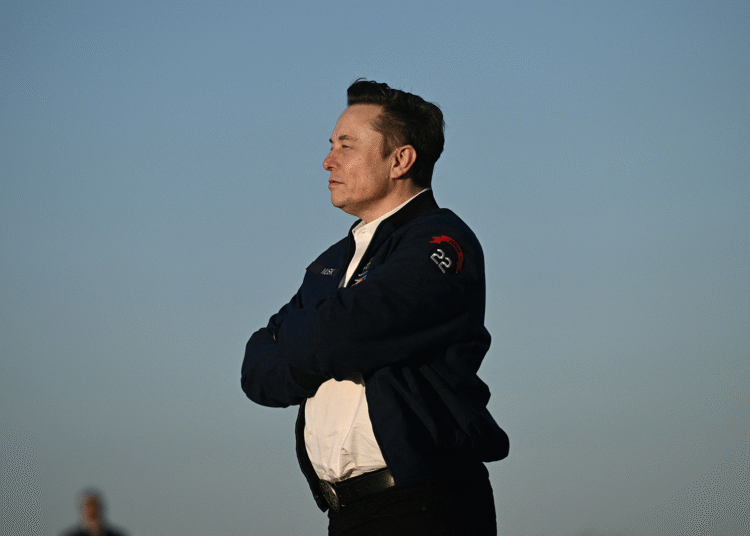

Elon Musk’s indirect influence

While Musk himself is not formally involved, his fingerprints are everywhere. Spiro has defended him in high-profile Dogecoin lawsuits and helped win dismissal of a market-manipulation case in 2024. Historically, Musk’s tweets have produced average abnormal returns of 23-33 percent for DOGE in the hours that follow. A treasury company chaired by his confidant adds another layer of perceived Musk endorsement.

How Investors Could Benefit from a Public DOGE Treasury

- Simple exposure through a brokerage account

Many institutional investors cannot hold crypto directly for compliance reasons. Owning stock in a DOGE-rich company circumvents those custody hurdles while preserving upside if Dogecoin rallies. - Potential premium to net asset value (NAV)

Shares of MicroStrategy and other crypto treasuries often trade well above the dollar value of their underlying coins because investors pay for convenience and leverage. Early shareholders could see outsize gains if the market bids the Spiro-led company to a similar premium. - Diversification away from Bitcoin hegemony

Most treasury plays are BTC-only. A DOGE vehicle broadens the menu for investors who believe alternative Layer-1 assets or meme-driven communities can outperform in certain cycles. - Marketing flywheel

House of Doge gains legitimacy by having a regulated, audited proxy on a major exchange, and the company gains marketing wattage from being “the official Dogecoin treasury.” That symbiosis can attract both retail hype and institutional buy-in. - Potential future utilities

Treasury firms sometimes layer services—e.g., lending out assets or staking—to generate yield. Although Dogecoin is proof-of-work today, future network upgrades or Layer-2 integrations could create additional revenue streams for the company and its shareholders.

Risks, Red Flags, and Practical Safeguards

1. Price Volatility and Over-Concentration

Dogecoin remains a meme-coin with no capped supply and limited core utility. A single treasury-heavy balance sheet magnifies both upside and downside. Even MicroStrategy suffered a 70 percent drawdown in 2022’s bear market despite a lower volatility asset (BTC).

Mitigation: Shareholders should scrutinize leverage levels, debt covenants, and whether management plans to hedge using derivatives or maintain fiat buffers.

2. Musk Tweet Dependence

Academic studies confirm that DOGE rallies tend to fade within days of Musk’s social-media bursts. A treasury firm can’t control his posting cadence, making price support shaky if the hype cycle cools.

Mitigation: Evaluate whether the company intends to engage developers, foster utility partnerships, or otherwise reduce reliance on meme momentum.

3. Regulatory Scrutiny

U.S. regulators are already investigating potential insider trading tied to corporate crypto pivots. A high-profile DOGE treasury with Musk’s attorney on the masthead could draw extra heat.

Mitigation: Investors should watch for transparent disclosure policies, third-party custody, and Sarbanes-Oxley compliance to limit governance risk.

4. Dilution and Capital Raises

MicroStrategy repeatedly issued stock to buy BTC; existing holders absorbed dilution but hoped rising Bitcoin prices would offset it. The Spiro entity may follow the same playbook.

Mitigation: Track share-issuance plans and insist on shareholder votes for large secondary offerings.

5. Liquidity Premium vs. NAV

History shows that when sentiment flips, premiums can collapse to discounts, trapping latecomers in losses even if DOGE’s on-chain price stays flat.

Mitigation: Compare market cap to treasury NAV regularly and avoid buying at extremes.

Conclusion: A High-Beta Bet on Dogecoin’s Next Chapter

The proposed $200 million Dogecoin treasury company gives mainstream investors a leveraged, regulated gateway to DOGE—but with leverage comes risk. Spiro’s credibility and the House of Doge’s backing provide institutional gloss, yet the venture will succeed only if Dogecoin’s memetic power persists beyond Musk’s tweets. For investors comfortable with volatility and eager for a novel crypto-equity play, the stock could serve as a speculative satellite position. Everyone else should tread carefully, monitor NAV premiums, and treat the ticker as a sentiment gauge rather than a guaranteed moonshot.