Dollar weakness is becoming a pressing concern for investors as the greenback continues to decline amidst economic growth fears. The latest US dollar news highlights a notable drop in the dollar index, which has plummeted to a 4-3/4 month low, primarily driven by the potential fallout from recent trade tariffs imposed on key trading partners such as Canada, China, and Mexico. As uncertainty grows over the implications of these tariffs on the USD trade impact, market analysts are closely monitoring dollar index analysis to understand future trends. With economic growth concerns escalating, the demand for safe-haven assets like gold has surged, further complicating the dollar’s trajectory. Thus, the interplay between trade policies and the strength of the dollar is critical for stakeholders navigating this volatile financial landscape.

The current state of the dollar, often referred to as the greenback, is under significant scrutiny as it experiences marked depreciation. This trend of dollar depreciation, driven by economic instability and trade policy repercussions, is prompting analysts to investigate its broader implications on global markets. As fluctuations in currency value ebb and flow, traders are keenly aware of how these shifts in dollar performance affect international trade dynamics and investment strategies. In light of the increasing trade tariffs effect on market confidence, understanding the nuances of this currency’s journey is vital for those engaged in financial markets. This ongoing analysis invites discussions around the fundamental health of the economy and the potential corrective measures that may restore balance.

Understanding Dollar Weakness in Global Markets

Dollar weakness has become a key theme in current global market dynamics, particularly in light of recent economic reports and geopolitical maneuvers. As the dollar index (DXY00) recently hit a four-and-a-half-month low, financial analysts are scrutinizing various factors that contribute to this decline. This downturn can primarily be traced back to rising economic growth concerns in the United States and the impact of recently implemented trade tariffs on Canada, China, and Mexico. The prospect of trade wars has spooked investors, leading to a flight towards safe-haven assets, thereby diminishing confidence in the dollar’s strength.

Compounding these issues, the release of US employment data revealed surprising results that further challenged the dollar’s standing. Despite an unexpected increase in job openings, the markets reacted negatively, highlighting broader uncertainties regarding the labor market’s recovery and potential impacts on consumer confidence. With the upcoming US CPI report and ongoing tariff debates on the horizon, observers are keeping a keen eye on how these developments will influence USD trade impact and perceptions of dollar stability in the face of economic challenges.

The Impact of Trade Tariffs on the Dollar Index

The recent implementation of 25% tariffs on steel and aluminum imports has raised alarm bells for investors, leading to increased volatility in the financial markets. Trade tariffs play a significant role in shaping economic conditions and have a pronounced effect on the dollar index. As manufacturers and consumers brace for increased costs, fears mount over inflationary pressures that could stifle economic growth, thereby weakening the dollar further. Tracking the dollar index becomes essential as it reflects investors’ sentiments regarding the overall health of the US economy amidst these challenges.

Additionally, the impact of trade tariffs goes beyond immediate costs; it influences global trade dynamics and relationships with other economies. The United States‘ aggressive stance could provoke retaliation from trading partners, which would further undermine confidence in the dollar. This ripple effect is particularly visible in the euro’s rise against the dollar, as traders shift their focus to perceived stability in other currencies. Thus, understanding the correlation between trade tariffs and the dollar is vital for predicting the ongoing trends in foreign exchange markets.

Effects of Economic Growth Concerns on Dollar Values

Economic growth concerns have become increasingly pertinent in today’s market, contributing significantly to the depreciation of the dollar. As analysts prepare for an anticipated easing of the CPI, there’s a growing sentiment that overall economic momentum is stalling. This deceleration can potentially affect Federal Reserve policies, causing speculation about future interest rate adjustments. If the Fed opts for a more cautious approach in light of growth fears, it could further drag down the dollar’s value.

Investors are particularly wary of the implications that weak economic indicators have for GDP growth and consumer spending, as these elements are crucial to the dollar’s health. A noticeable slowdown might lead to lower consumer confidence and hinder domestic economic activities, prompting discussions around fiscal measures to reignite growth. As growth concerns linger, the influence it exerts on the dollar’s performance is undeniable, with traders closely monitoring any shifts in economic data that may signal a change in sentiment.

Evaluating the Future of the Dollar Amid Global Economic Turbulence

With significant economic and political shifts unfolding, evaluating the future of the dollar requires a nuanced understanding of the interplay between domestic and global factors. Recent reports indicate that the prospects for the dollar could remain bleak if economic growth concerns persist. Furthermore, the increasing likelihood of retaliation from trading partners due to US tariffs creates an atmosphere of uncertainty, which could further weaken the dollar against other currencies.

As market participants consider potential policy responses from the Federal Reserve, the sentiment among traders is shifting. Any signals from monetary authorities aiming to stabilize the dollar amidst rising inflation and trade tensions will be closely scrutinized. Viewing the dollar’s movements in relation to economic indicators and geopolitical developments will be crucial in shaping our understanding of its future trajectory against major currencies globally.

The Role of JOLTS Data in Dollar Movement

The Job Openings and Labor Turnover Survey (JOLTS) is an influential report that often drives day-to-day fluctuations in the dollar’s value. The latest increase in job openings, while initially seen as a positive sign, presented a mixed message to investors regarding the overall health of the labor market. Although the data showed an unexpected rise, it highlighted ongoing vulnerabilities that could suggest deeper economic issues, thus influencing dollar stability.

Understanding how JOLTS data reflects labor market dynamics provides insight into how it impacts investor sentiment. Rising job openings could suggest a potential rebound in employment; however, persistent concerns about weak economic growth may overshadow this data’s positive aspects. Thus, analysts and traders must assess JOLTS outcomes alongside broader economic signals to fully grasp their implications for the dollar’s future performance.

Analyzing Consumer Sentiment and Its Effects on the Dollar

The consumer sentiment index is another critical element influencing the dollar, as it reflects consumers’ perceptions of their financial stability and willingness to spend. As the upcoming University of Michigan’s consumer sentiment report is expected to reflect a decline, this could put further pressure on the dollar amidst already shaky economic foundations. A drop in consumer confidence may signal decreasing consumer spending, an essential driver of economic growth.

Traders are keenly aware that diminishing consumer sentiment can lead to ripple effects across various sectors, including retail and housing, ultimately impacting GDP growth and the dollar’s strength. Thus, the link between consumer sentiment and the dollar cannot be understated—as confidence wanes, so too does support for the dollar, prompting deeper concerns over potential economic stagnation and encouraging investors to reassess their exposure to USD.

Monitoring Global Economic Indicators for Dollar Predictions

In an interconnected global economy, monitoring international economic indicators is essential for understanding trends affecting the dollar. The interplay of global economic growth and US economic performance will dictate the strength of the dollar relative to other currencies like the euro and yen. As markets react to economic reports from other nations, the dollar’s relative strength holds implications for trade balances and investments.

Moreover, investors should note how shifts in foreign economies—such as changes in consumer demand or production output—impact the US dollar. The ebb and flow of international trade relationships frequently mold expectations for currency value. As analysts keep tabs on these metrics, the future of the dollar remains enmeshed within a broader narrative of global economic developments.

The Influence of Interest Rates on Dollar Value

Interest rates play a foundational role in the valuation of the dollar, with changes to the Federal Reserve’s monetary policy directly influencing its strength. Speculative discussions about potential rate cuts during upcoming meetings have led market participants to reassess the outlook for the dollar, often resulting in fluctuations based on shifts in expectations. As fears of economic slowdowns grow, the potential for lower interest rates heightens, which would typically lead to a weaker dollar.

Consequently, understanding the relationship between interest rates and the dollar strengthens the overall analysis of currency movements. Traders must consider not only the Federal Reserve’s actions but also global interest rate trends, as adjustments in foreign central bank policies can impact the appeal of the dollar in international markets. Keeping a pulse on shifting interest rates is crucial for predicting the currency’s future performance.

Examining Currency Exchange Rate Trends in Light of Dollar Weakness

As the dollar weakens, currency exchange rate trends present a compelling area of analysis. The relationship between the dollar and other major currencies such as the euro and yen is particularly dynamic, reflecting investor sentiment and global economic conditions. The recent increase in the euro against the dollar serves as a direct illustration of this phenomenon, with shifts in trade relationships and economic outlooks prompting exchanges that alter the landscape for forex traders.

Moreover, understanding these trends involves looking beyond immediate fluctuations to consider the broader implications on international trade. A weakened dollar can increase import costs while making US exports more competitive. Therefore, businesses and economists alike must navigate the complexities posed by dollar movements, striving to predict how exchange rate changes will affect global trade dynamics and ultimately shape future dollar values.

Navigating Market Sentiment during Times of Dollar Decline

During times of dollar decline, market sentiment becomes a driving force that influences trader behavior. The perception of economic stability can either reinforce or undermine confidence in the dollar, affecting everything from the forex markets to commodity prices. Consequently, as the dollar weakens in response to trade concerns and economic indicators, it is imperative for traders to gauge overall market sentiment and adjust strategies accordingly.

For instance, the rise in demand for precious metals amid dollar weakness reflects a shift in market sentiment toward safe-haven assets. As economic uncertainties unfold, understanding how traders react can provide insight into future dollar trends and overall market direction. Therefore, navigating market sentiment effectively is paramount for making informed decisions while capitalizing on potential opportunities in an evolving financial landscape.

Frequently Asked Questions

What factors are contributing to dollar weakness in the current market?

The recent dollar weakness can be attributed to several factors, including US economic growth concerns and the imposition of tariffs on imports from Canada, China, and Mexico. These tariffs have heightened fears of a potential trade war, which may adversely affect the US economy and weaken the dollar further.

How do US tariffs affect the dollar index analysis?

US tariffs contribute significantly to dollar index analysis by creating uncertainty in the market. As trade tensions rise, investors often move away from the dollar, leading to a decline in the dollar index. The current tariffs of 25% on steel and aluminum imports are a prime example of how trade policies can cause dollar weakness.

What is the impact of economic growth concerns on USD trade impact?

Economic growth concerns have a notable USD trade impact, as they can lead to reduced investor confidence in the dollar. Weak labor market data, such as the recent JOLTS report showing lower-than-expected job openings, tends to weaken the dollar, prompting traders to favor other currencies.

How does the current dollar weakness affect precious metals prices?

Dollar weakness typically supports higher precious metals prices. With the dollar index recently falling to a 4-3/4 month low, we’ve seen gold and silver prices rise. A weaker dollar reduces the cost of metals for investors holding foreign currencies, stimulating demand for precious metals as a safe haven.

Is the dollar weak due to inflation concerns?

Yes, inflation concerns play a critical role in dollar weakness. With expected easing of both the Consumer Price Index (CPI) and core CPI, market sentiment can shift towards expecting lower interest rates, which often results in dollar depreciation as investors seek higher yields elsewhere.

What role does the Federal Reserve play in dollar weakness?

The Federal Reserve’s policy decisions greatly influence dollar strength. Expectations of a rate cut at the upcoming FOMC meeting can lead to dollar weakness, as lower interest rates generally reduce the return on dollar-denominated assets, making the dollar less attractive to foreign investors.

How does dollar weakness impact international trade?

Dollar weakness can benefit US exports by making American goods cheaper for foreign buyers, potentially increasing competitiveness in the global market. However, it may also inflate the cost of imports, leading to trade imbalances that can further complicate economic growth issues.

How does the euro’s rise relate to dollar weakness?

The euro’s rise is often inversely correlated with dollar weakness. As the dollar index declines, as seen recently, the euro strengthens, making it more favorable for European exports and leading to a shift in trade dynamics between the US and Eurozone.

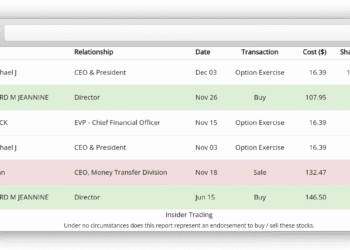

| Key Point | Details |

|---|---|

| Dollar Index Decline | The dollar index (DXY) is down -0.42%, reaching a 4-3/4 month low due to growth concerns. |

| Impact of Trade Tariffs | Recent tariffs on Canada, China, and Mexico raised fears of a trade war, negatively impacting the dollar. |

| Job Market Data | US JOLTS job openings rose to 7.74 million, exceeding expectations but still indicating labor market weakness. |

| Upcoming Economic Reports | Market will focus on the February US CPI report and potential impacts on inflation and policy rates. |

| Currency Movements | EUR/USD rose +0.73% while USD/JPY increased +0.31%, influenced by broader economic conditions. |

| Precious Metals Trends | Gold and silver prices rose due to dollar weakness and ongoing safe-haven demand amid trade tensions. |

Summary

Dollar weakness is a significant concern for investors as it reflects economic uncertainties in the US. The recent drop in the dollar index to a 4-3/4 month low has raised alarms about potential trade wars sparked by tariffs on major trading partners. As economic indicators, such as job openings, suggest a softer labor market, the outlook remains cautious heading into upcoming reports on inflation and economic sentiment. Thus, the continued weakness of the dollar may have broader implications for market dynamics across currencies and commodities.