The recent E-mini S&P breakout has captured the attention of traders as it reaches levels not seen since early February. As the broader S&P 500 index movements intensify, the backdrop of strong job growth and shifting market dynamics has prompted many to reassess their strategies. With the latest Nonfarm Payrolls report indicating robust wage growth and a healthy labor market, investors are evaluating their positions in anticipation of potential Federal Reserve rate cuts. This environment necessitates vigilant market analysis, especially with the E-mini NQ also experiencing significant gains. As bulls strive to maintain this breakout momentum, signals from the tech sector could play a pivotal role in shaping future market trends.

The recent surge in E-mini S&P futures signifies not only a crucial market breakout but also an important moment for investors focused on U.S. equities. With the corresponding E-mini NQ futures demonstrating similar bullish movements, traders are eager to see if this upward trend can be sustained in light of strong economic indicators, such as impressive job creation numbers. Capitalizing on these developments, savvy market analysts are dissecting the implications of potential monetary policy shifts by the Federal Reserve on their investment strategies. The interplay between the performance of technology stocks and broader financial metrics like wage growth further complicates the outlook. This period of heightened volatility invites both opportunity and risk, making it essential for market participants to stay informed and adaptable.

E-mini S&P Breakout: Analyzing the Latest Trends

The recent breakout in E-mini S&P futures indicates a significant bullish trend, settling at 6016.75 with an impressive weekly gain. This upward movement reflects strong investor confidence in the market, particularly after the positive Nonfarm Payrolls report showed job growth exceeding expectations. With the S&P 500 on a notable rise, analysts are keenly observing whether this momentum can be sustained amidst evolving economic conditions.

Investor sentiment appears optimistic, fueled by robust wage growth and a favorable employment report. However, the specter of a potential rate cut has recently diminished, with current forecasts lowering the likelihood of such a monetary policy shift by the Federal Reserve. The upcoming quarterly economic projections will be critical in gauging future market directions, especially as traders place their bets on technology stocks which have shown resilience.

S&P 500 Market Analysis: Supporting Factors for Growth

Recent market analysis highlights a compelling growth trajectory for the S&P 500, bolstered by strong job growth figures and positive economic indicators. The rise in average hourly wages alongside lower unemployment rates has provided a robust foundation for consumer spending, which is essential for ongoing market resilience. Analysts are particularly focused on the effects of these metrics on the broader economic landscape and stability of the S&P 500.

Moreover, as we draw closer to the Federal Reserve’s meeting, traders remain vigilant about any shifts in policy that could influence the market dynamics. The reduction in the projected probability for a rate cut signals a shift towards a potentially stable monetary environment. This, combined with surging tech stocks within the index, presents a favorable backdrop for continued strength in the S&P 500.

Job Growth Trends: Implications for Financial Markets

Job growth trends play a pivotal role in shaping the outlook for financial markets, as evidenced by the latest Nonfarm Payrolls report indicating an increase of 139,000 jobs. This figure not only surpassed economists’ forecasts but also reflects a demand for labor that could lead to further economic expansion. A strong labor market typically translates to increased consumer confidence and spending, which is a catalyst for stock market gains.

Furthermore, consistent job growth may impact the Federal Reserve’s monetary policy decisions. With the labor market showing resilience, the Fed may adopt a more cautious approach to interest rate adjustments, prioritizing economic stability over aggressive rate cuts. Market participants will be closely watching these developments, as shifts in employment data can influence strategies and investment decisions across various sectors.

Technological Resilience: The Role of E-mini NQ

As the E-mini NQ continues to achieve significant closing levels, the resilience of technology stocks has become a focal point for investors. The tech sector’s robust performance has been a driving force behind recent market advances, indicating strong investor interest and confidence. Despite minor fluctuations in prices, the underlying strength in tech fundamentals remains supportive for upward trends in the E-mini NQ.

The noteworthy performance of major tech firms plays a crucial role in bolstering the E-mini NQ, showcasing sustained innovation and growth. Traders are particularly attentive to the earnings reports and tech adoption trends, which often serve as precursors to broader market movements. As the sector leads the charge, understanding its dynamics will be fundamental for investors aiming to capitalize on potential profit opportunities.

The Impact of Interest Rates on Market Dynamics

Interest rates are a critical factor influencing market dynamics, and recent updates suggest little chance of immediate cuts from the Federal Reserve. The projected likelihood of a rate cut dropping to 14.5% underscores a cautious stance from policymakers, likely impacting investment strategies across various asset classes. Higher interest rates historically correlate with reduced borrowing, which can slow down economic growth and subsequently affect market valuations.

Conversely, maintaining or increasing interest rates can signal economic strength, often leading to enhanced investor sentiment in equity markets. As rate decisions loom, markets are actively interpreting every economic indicator for signs of potential shifts in monetary policy. Understanding these implications is vital for traders who seek to navigate an uncertain economic landscape.

Market Sentiment: Gauging Investor Confidence

Market sentiment remains a crucial indicator of future trends, particularly as the S&P 500 and E-mini NQ reflect bullish patterns. Current investor confidence appears bolstered by positive job growth data, which may lead to an optimistic outlook for upcoming earning seasons and general market activity. However, ongoing fluctuations in sentiment can lead to volatility, requiring stakeholders to remain adaptable and responsive to new economic signals.

Such sentiments are often reflected in trader activity, impacting market performance. As the economic landscape evolves, keeping a pulse on investor reactions to new data releases will remain vital. Whether driven by strong fundamentals or macroeconomic trends, understanding these dynamics will help investors make informed decisions regarding their portfolios and strategies.

Sector Focus: The Importance of Technology Stocks

Technology stocks are playing a decisive role in driving market momentum, as evidenced by their significant contributions to the performance of the E-mini NQ. This sector not only facilitates innovation and productivity gains but also attracts a considerable share of investment, reflecting growing investor trust. Key players in technology continue to showcase impressive earnings and growth potential, significantly influencing overall market health.

Furthermore, as technology increasingly permeates various industries, its impact on economic growth becomes even more pronounced. Investors are encouraged to monitor sector-specific trends, including advancements in AI, cloud computing, and cybersecurity, which are likely to shape future profitability and market trajectories. As such, the technology sector remains a pivotal focus for strategic asset allocation.

Economic Indicators: Preparing for Future Market Movements

Economic indicators serve as critical tools for investors aiming to anticipate and react to market changes. Reports such as the Nonfarm Payrolls data, inflation rates, and wage growth provide insight into the health of the economy and are essential for forming informed investment decisions. Staying abreast of these indicators is vital as they can influence central bank policies, which in turn affect market valuations.

As market participants prepare for upcoming releases, there is an acute focus on how these economic signals may affect sentiment and trading patterns. A holistic understanding of economic indicators can empower investors to devise sound strategies and mitigate risk in fluctuating markets. Ultimately, a proactive approach to monitoring these data points is advisable for anyone looking to navigate the complexities of the current financial landscape.

Investment Strategies: Navigating with Caution

As the volatility of the market persists, investment strategies must adapt accordingly, emphasizing the necessity for caution among traders. With the E-mini S&P and E-mini NQ showing significant gains, the potential for short-term corrections could unsettle the bullish trend. Investors are advised to maintain a balanced approach, ensuring that portfolios are diversified in a climate of uncertainty while also capturing the upside potential from these leading indices.

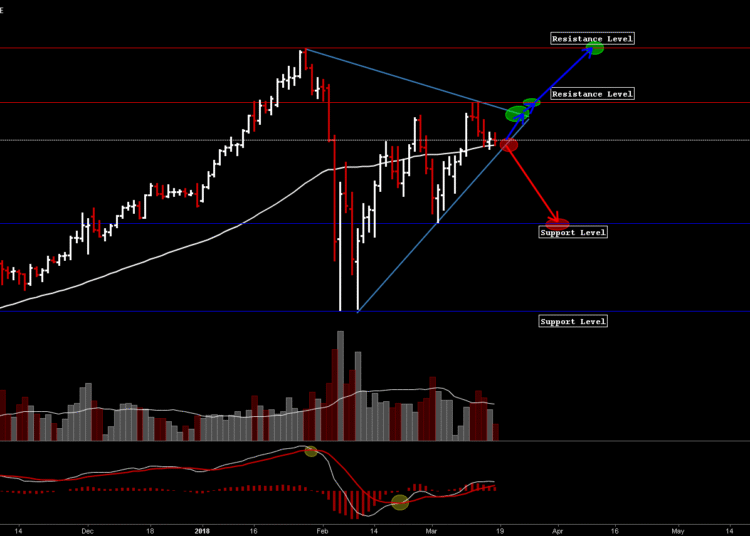

Moreover, developing clear entry and exit strategies based on technical analysis can offer a distinct advantage in this market. By utilizing key support and resistance levels, investors can better position themselves to take advantage of price movements effectively. Keeping abreast of macroeconomic trends and aligning them with strategic trading principles remains paramount to achieving success in today’s dynamic environment.

Conclusion: Staying Informed in a Shifting Landscape

In conclusion, as market dynamics evolve, it is imperative for investors to stay informed and remain agile. The interplay of job growth, interest rates, and technology’s prominence will continue to shape trading strategies and perceptions of market health. Engaging in thorough market analysis will be key for investors looking to capitalize on opportunities presented by this shifting landscape.

By subscribing to reliable market insights, such as daily updates and analytical reports, traders can navigate the complexities of the financial environment with greater confidence. Awareness of macroeconomic trends, sector performance, and investor sentiment will serve as essential guides for making informed decisions, reinforcing the need for ongoing market engagement.

Frequently Asked Questions

What is the significance of the recent E-mini S&P breakout?

The recent E-mini S&P breakout at 6019.50 represents a critical level of resistance that, once exceeded, signals bullish market sentiment. This breakout occurs amid favorable job growth data and influences market analysis, indicating potential for further advancement in the S&P 500.

How does job growth impact the E-mini S&P breakout?

Job growth plays a pivotal role in influencing the E-mini S&P breakout. Strong employment figures, like the recent 139k jobs added, bolster investor confidence and can lead to increased buying pressure, supporting sustained upward movements in the E-mini S&P.

What factors should traders consider when analyzing the E-mini S&P breakout?

When analyzing the E-mini S&P breakout, traders should consider market analysis reports, job growth data, and the potential for Federal Reserve rate cuts. These variables can all affect market sentiment and lead to significant price fluctuations.

How does the E-mini NQ relate to the E-mini S&P breakout?

The E-mini NQ often correlates with the E-mini S&P breakout, reflecting similar bullish trends within technology stocks. As tech leads the market, watching the E-mini NQ provides insights into the strength of the E-mini S&P breakout and overall market direction.

Can rate cut expectations influence E-mini S&P breakout patterns?

Yes, expectations of a Federal Reserve rate cut can significantly influence E-mini S&P breakout patterns. When rate cuts are anticipated, it tends to lower borrowing costs, potentially stimulating investment and driving prices higher within the S&P 500.

What levels should be monitored during an E-mini S&P breakout?

During an E-mini S&P breakout, traders should monitor key resistance levels, such as the recent highs near 6019.50, as well as support levels like 5938.25-5943.50. These levels provide critical benchmarks for determining the continuation of a bullish trend.

What role does the CPI report play in the context of an E-mini S&P breakout?

The Consumer Price Index (CPI) report plays a crucial role in the context of an E-mini S&P breakout as it impacts inflation expectations. A favorable CPI report may support bullish sentiments, reinforcing the breakout and influencing decision-making regarding future rate cuts.

What indicators suggest potential exhaustion in the E-mini S&P breakout?

Indicators of potential exhaustion in the E-mini S&P breakout may include a failure to maintain price levels above key resistance or significant divergence in technical indicators like volume and momentum. Monitoring these signs can help traders assess the sustainability of the bullish trend.

| Key Point | Details |

|---|---|

| E-mini S&P Performance | Settled at 6006.75, up 60.75 on Friday and 90.75 for the week. |

| E-mini NQ Performance | Closed at 21,789.50, up 207.25 on Friday and 412.75 for the week. |

| Nonfarm Payrolls Report | Job growth was better than expected at 139k for May; wage growth at +0.4% MoM. |

| Federal Reserve Rate Cut Speculation | Likelihood of a rate cut dropped to 14.5% before the July meeting. |

| Resistance Levels | Significant resistance tested; E-mini S&P’s three-star support is at 5938.25-5943.50. |

| Market Outlook | Technology leads but a reversal may occur; maintain watch on pivot points. |

Summary

The E-mini S&P breakout is central to understanding current market dynamics as technology stocks regain leadership. Recent performance shows a strong finish for E-mini S&P and E-mini NQ, attributed to positive job growth and wage increases. With rate cut expectations diminished, traders remain cautious about resistance levels and potential market reversals. Keeping an eye on pivot points will be essential for navigating this market.