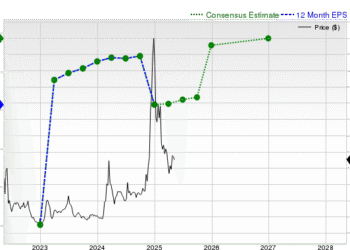

EML Payments financial performance in FY24 has shown remarkable resilience and growth, highlighting the company’s strategic shift and operational improvements. Under the leadership of Ron Hynes, who took the helm as CEO, EML has successfully addressed long-standing challenges, paving the way for a robust foundation in the competitive payments industry. As a result, the company reported an 18% increase in revenue, reaching $217.3 million, driven by enhanced customer engagement and treasury performance. Furthermore, EML’s underlying EBITDA surged by 54%, showcasing effective cost management and operational efficiency. With the launch of the EML 2.0 strategy, the company is poised for sustained growth and aims to capitalize on the burgeoning payments industry, ensuring that it remains a key player in the ASX market.

In the fiscal year 2024, the financial results of EML Payments have emerged as a testament to its evolving business strategy and operational excellence. The recent performance highlights, articulated by CEO Ron Hynes, reflect a strategic repositioning aimed at overcoming previous hurdles while enhancing market competitiveness. The impressive rise in revenue and profit margins underscores the effectiveness of their initiatives, particularly the newly introduced EML 2.0 strategy, which focuses on nurturing existing customer relationships and unlocking new revenue streams. As the payments landscape continues to expand, EML is strategically aligned to leverage this growth, ensuring it captures significant market share. Overall, the enhanced financial position sets an optimistic tone for future endeavors and stakeholder confidence in EML’s trajectory.

EML Payments Financial Performance: A Strong FY24

EML Payments (ASX: EML) has demonstrated remarkable financial performance in the fiscal year 2024, reflecting a significant turnaround from previous challenges. Under the leadership of Ron Hynes, who took over as CEO in July, the company has effectively tackled long-standing structural issues that had previously hindered growth. This revitalization is evident in the impressive 18% increase in revenue, which surged to $217.3 million, driven largely by enhanced customer revenue and improved treasury yield performance on float balances. This upward trajectory indicates not only a recovery but a robust foundation for future growth in the payments industry.

Moreover, the company’s underlying EBITDA skyrocketed by 54%, reaching $57.1 million and sitting comfortably within the guidance range set by the management. This financial performance is bolstered by strategic decisions, including the successful sale of its Sentenial business for $53.4 million, which has significantly strengthened EML’s balance sheet. Such financial milestones are crucial as they position EML Payments as a formidable player in the payments landscape, paving the way for double-digit transaction revenue growth in the coming years.

The Impact of EML 2.0 Strategy on Growth

The introduction of the EML 2.0 strategy marks a pivotal moment for the company as it seeks to establish itself as a leader in the payments industry. Ron Hynes laid out this strategy, which focuses on three growth pillars supported by essential enablers that will guide EML’s future direction. The primary focus is on nurturing and growing the core business, which is foundational to EML’s success. By strengthening relationships with over 1,000 existing customers, EML aims to foster trust and collaboration that can unlock new revenue opportunities.

The EML 2.0 strategy also emphasizes the importance of innovation and adaptability in a rapidly evolving payments landscape. By leveraging its established infrastructure and customer base, EML is well-positioned to capitalize on the growing trends within the payments industry. The strategic focus on deepening existing relationships and exploring new avenues for growth reflects a proactive approach to sustaining financial performance while navigating the complexities of modern money flows.

Ron Hynes: Leadership Driving EML Payments Forward

Ron Hynes’ appointment as CEO marks a significant turning point for EML Payments, especially as the company embarks on its 2.0 strategy. His extensive experience and vision for the company have been pivotal in addressing the structural challenges that previously hindered EML’s growth trajectory. Hynes’ leadership is characterized by a commitment to transparency and a collaborative approach, which has resonated with both employees and stakeholders. His proactive measures have laid the groundwork for a more resilient organization that can thrive in the competitive payments landscape.

Under Hynes’ direction, the company is not just focusing on immediate financial performance but is also setting the stage for sustainable growth. This includes fostering a culture of innovation and responsiveness to market demands. By aligning the company’s strategic goals with the needs of its customers, Hynes is steering EML Payments towards a future of enhanced profitability and market leadership.

Navigating Challenges in the Payments Industry

The payments industry is rife with challenges, from regulatory changes to technological advancements that require constant adaptation. EML Payments has faced these challenges head-on, particularly in the context of its financial performance in FY24. The comprehensive restructuring under Ron Hynes’ leadership has equipped the company to navigate these complexities and emerge stronger. By addressing long-standing issues, EML has improved its operational efficiency and positioned itself strategically to capitalize on growth opportunities.

In this dynamic environment, EML’s commitment to understanding and responding to customer needs has been crucial. The company’s ability to innovate and adapt has not only mitigated risks but also enhanced its value proposition. As EML Payments continues to refine its strategies and operational capabilities, it remains focused on overcoming industry challenges, ensuring that it remains a competitive player in the evolving payments landscape.

Customer-Centric Approach in EML Payments Strategy

At the heart of EML Payments’ strategy is a commitment to a customer-centric approach, which is crucial for driving long-term financial performance. The company recognizes that its existing customer base of over 1,000 clients is the backbone of its operations. By prioritizing relationship-building and understanding customer needs, EML aims to enhance customer loyalty and satisfaction. This focus not only supports immediate revenue growth but also lays the groundwork for sustainable success in the competitive payments industry.

The emphasis on customer collaboration is a key element of EML’s strategy, as it seeks to unlock new revenue opportunities through innovative solutions tailored to client needs. By leveraging technology and data-driven insights, EML can better serve its customers and respond proactively to market demands. This approach not only strengthens existing partnerships but also positions EML as a trusted leader in the payments sector, capable of navigating the complexities of modern finance.

Future Outlook for EML Payments in the Payments Industry

As EML Payments looks ahead, the future appears promising, particularly with the successful implementation of its EML 2.0 strategy. The company is poised to capitalize on the anticipated growth in the payments industry, driven by evolving consumer behaviors and technological advancements. With a solid financial foundation established in FY24, EML is well-equipped to invest in new initiatives that will further enhance its market position.

Moreover, the ongoing focus on innovation and customer-centric solutions will be essential for sustaining growth. EML Payments aims to remain agile, adapting to changes in the industry while continuing to deliver value to its customers. This proactive strategy not only addresses immediate financial concerns but also sets the stage for long-term success in a rapidly changing payments landscape.

The Role of Financial Metrics in EML Payments’ Strategy

Financial metrics play a crucial role in shaping EML Payments’ strategy and guiding its operational decisions. The significant improvements in revenue and EBITDA reported for FY24 are not just numbers; they reflect the effectiveness of the company’s strategic initiatives led by Ron Hynes. By closely monitoring these metrics, EML can assess its performance against industry benchmarks, ensuring that it remains competitive in the payments sector.

Additionally, financial metrics provide valuable insights into customer behavior and market trends. By analyzing revenue growth and customer engagement levels, EML Payments can make informed decisions about future investments and strategic directions. This data-driven approach enables the company to align its operations with the evolving needs of its clients, ultimately fostering a more resilient and responsive business model.

Strengthening EML Payments’ Competitive Edge

In the highly competitive payments industry, EML Payments recognizes the importance of strengthening its competitive edge. The successful execution of the EML 2.0 strategy is a testament to the company’s commitment to innovation and adaptability. By prioritizing customer relationships and operational efficiency, EML is positioning itself as a leader in the market. This strategic focus not only enhances the company’s reputation but also drives sustainable growth in transaction revenues.

Furthermore, the recent financial performance improvements serve as a solid foundation for EML Payments to differentiate itself from competitors. By leveraging its unique value proposition and proven track record in navigating complex money flows, the company is well-prepared to respond to the evolving demands of the payments landscape. As EML continues to strengthen its market position, it remains focused on delivering exceptional value to its customers and stakeholders.

Leveraging Technology for Growth at EML Payments

Technology is a critical enabler for EML Payments as it seeks to enhance its financial performance and navigate the complexities of the payments industry. The ongoing investment in innovative technological solutions is essential for improving operational efficiency and delivering superior customer experiences. By leveraging data analytics and automation, EML can streamline its processes and provide tailored solutions that meet the diverse needs of its clients.

Additionally, technology plays a vital role in supporting EML’s growth strategy. As the company embraces digital transformation, it can explore new revenue streams and expand its market reach. By staying at the forefront of technological advancements, EML Payments is well-positioned to capitalize on emerging trends in the payments industry, ultimately driving sustainable financial performance and long-term success.

Frequently Asked Questions

What is the recent financial performance of EML Payments ASX for FY24?

EML Payments (ASX: EML) reported significantly improved financial performance in FY24, with an 18% increase in revenue to $217.3 million and a 54% rise in underlying EBITDA to $57.1 million, reflecting strong customer revenue growth and effective treasury yield performance.

How has Ron Hynes impacted EML Payments’ financial performance since his appointment?

Since Ron Hynes became CEO of EML Payments, he has addressed longstanding challenges, leading to a stronger financial performance in FY24, including a return to double-digit transaction revenue growth and a healthier balance sheet after strategic decisions like the sale of Sentenial.

What is the EML 2.0 strategy and how does it relate to EML Payments’ financial performance?

The EML 2.0 strategy, introduced by CEO Ron Hynes, focuses on three growth pillars and core enablers aimed at enhancing customer relationships and unlocking new revenue opportunities, which are essential for sustaining the improved financial performance of EML Payments.

What factors contributed to EML Payments’ financial performance growth in FY24?

Key factors contributing to EML Payments’ financial performance growth in FY24 include a robust 18% revenue increase driven by customer revenue and treasury yield performance, alongside the successful sale of the Sentenial business, which strengthened the company’s financial position.

What are the expectations for EML Payments’ financial performance in the payments industry following FY24?

Following the positive financial performance in FY24, EML Payments is well-positioned to lead in the payments industry, with expectations for continued growth driven by the EML 2.0 strategy and strengthened customer relationships.

How does EML Payments’ financial performance compare to industry growth trends?

EML Payments’ financial performance aligns with broader payments industry growth trends, demonstrating resilience and adaptability, particularly as it navigates the complexities of business, government, and consumer needs.

What role does customer revenue play in EML Payments’ financial performance?

Customer revenue is a crucial component of EML Payments’ financial performance, contributing significantly to the company’s 18% revenue growth in FY24, emphasizing the importance of deepening relationships with over 1,000 existing customers.

What impact did the sale of Sentenial have on EML Payments’ financial performance?

The sale of Sentenial for $53.4 million positively impacted EML Payments’ financial performance by enhancing its balance sheet and facilitating debt refinancing, thus positioning the company for future growth and stability.

| Key Metrics | FY24 Performance | Growth Drivers | Strategic Focus |

|---|---|---|---|

| Revenue | $217.3 million | Customer revenue growth, treasury yield performance | Nurturing existing customers and unlocking new revenue opportunities |

| Underlying EBITDA | $57.1 million (54% increase) | Sale of Sentenial for $53.4 million | EML 2.0 strategy focusing on three growth pillars |

| Debt Management | Healthier balance sheet post-refinancing | Addressing long-standing structural challenges | Strengthening foundations to lead in the payments industry |

Summary

EML Payments financial performance in FY24 demonstrates a significant turnaround, with a marked increase in key financial metrics. The company’s strategy, particularly the launch of the EML 2.0 initiative, is aimed at leveraging existing customer relationships to foster growth and enhance revenue streams. With a robust underlying EBITDA and improved balance sheet, EML is well-positioned to capitalize on new opportunities in the payments industry.