Fibonacci retracements are a vital component of market analysis, helping traders identify potential support and resistance levels. By utilizing Fibonacci levels, traders can develop effective trading strategies that capitalize on the natural ebb and flow of market movements. These retracement levels, particularly the key percentages like 23.6%, 38.2%, and 61.8%, provide insights into where the market may reverse direction or consolidate. For those who integrate Gann squares into their analysis, the combination with Fibonacci retracements can enhance the precision of their market predictions. Understanding how these tools interact can lead to more informed trading decisions and improved outcomes in a fluctuating market.

Often referred to as Fibonacci levels, these ratios are fundamental tools in the realm of technical trading. They serve as benchmarks for analyzing price movements and determining potential reversal points in the market. Traders frequently employ these ratios alongside Gann squares to reinforce their support and resistance assessments. By leveraging the insights from these mathematical principles, market participants can refine their trading strategies, leading to better risk management and profit potential. As such, mastering the art of using Fibonacci retracements can be pivotal for anyone looking to navigate the complexities of financial markets.

Understanding Fibonacci Retracements in Market Analysis

Fibonacci retracements are pivotal in technical analysis, acting as a tool to identify potential reversal levels in the financial markets. Traders often utilize these retracement levels to forecast future price movements based on historical price action. The key Fibonacci levels, such as 23.6%, 38.2%, 61.8%, and 78.6%, are derived from the Fibonacci sequence, a mathematical concept that appears in various natural phenomena. When applied to market analysis, these levels help in determining support and resistance, guiding traders in their decision-making processes.

At ONE44 Analytics, we emphasize the importance of Fibonacci levels as they reflect market psychology and trader behavior. For instance, a pullback to the 38.2% level often indicates a continuation of the prevailing trend, while a 61.8% retracement may signal a deeper correction. Understanding these dynamics allows traders to develop effective trading strategies that align with market movements. By integrating Fibonacci retracements with Gann squares, traders can enhance their market analysis, pinpointing precise entry and exit points.

The Role of Gann Squares in Identifying Market Trends

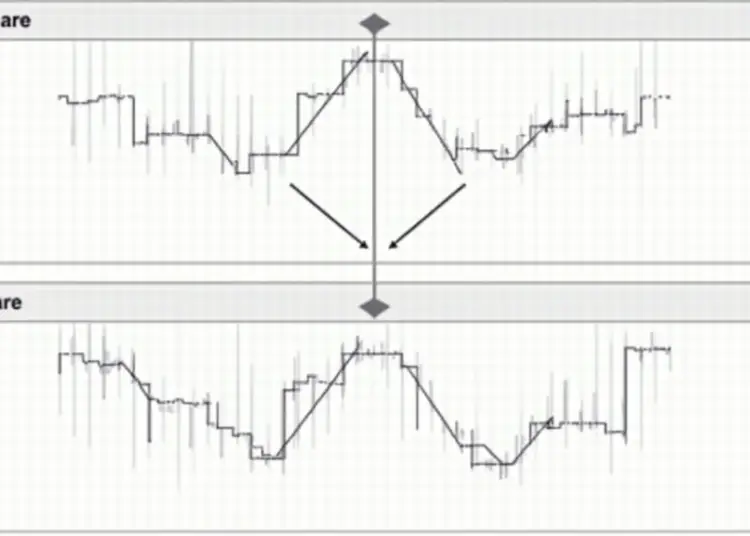

Gann squares represent a unique approach to market analysis, offering insights into potential turning points in price action. Developed by W.D. Gann, these squares are utilized to identify key support and resistance levels, which are crucial for traders aiming to capitalize on market fluctuations. The major Gann squares, illustrated in the ONE44 charts, provide clear visual indicators where price reversals may occur, guiding traders in their strategic planning.

In conjunction with Fibonacci retracements, Gann squares create a comprehensive framework for market analysis. For example, when the market approaches a major Gann square, it is essential to observe how it interacts with nearby Fibonacci levels. This synergy between Gann squares and Fibonacci retracements can reveal potential breakout or reversal opportunities, allowing traders to refine their trading strategies effectively. Consequently, understanding both tools enhances a trader’s ability to navigate complex market scenarios.

Key Trading Strategies Using Fibonacci Levels

Incorporating Fibonacci retracements into trading strategies can significantly improve decision-making in the markets. Traders often look for price action around key Fibonacci levels to initiate trades, with particular attention paid to the 61.8% and 78.6% levels. These levels not only serve as indicators of potential reversals but also help traders to set stop-loss orders and profit targets, creating a risk-managed trading environment.

Moreover, the use of Fibonacci levels in conjunction with Gann squares can enhance the effectiveness of trading strategies. For instance, if the market retraces to a 38.2% Fibonacci level while also approaching a Gann square, it creates a compelling setup for entering a trade. This dual confirmation can provide traders with greater confidence in their positions, increasing the chances of success. Overall, mastering these tools is essential for developing robust trading strategies that capitalize on market movements.

Analyzing Support and Resistance with Fibonacci and Gann

Support and resistance levels are fundamental concepts in trading, and using Fibonacci retracements alongside Gann squares can provide deeper insights into these critical areas. Fibonacci levels help identify areas where the price may bounce or reverse, while Gann squares offer a unique perspective on market structure. By analyzing both, traders can gain a clearer understanding of potential price action and market sentiment.

For example, when a market approaches the 61.8% Fibonacci retracement level, combined with a Gann square, traders often observe significant price reactions. This dual analysis allows for strategic planning, such as setting entry points near support levels and exit points at resistance levels. Understanding how these elements interact can lead to more informed trading decisions, ultimately enhancing profitability.

Implications of 78.6% Retracement in Market Trends

The 78.6% Fibonacci retracement level is particularly significant in market analysis, often indicating strong potential reversals or continuations of trends. At ONE44, we recognize that failing to establish a new high near this level can lead to sharp sell-offs, which traders must closely monitor. This level serves as a critical swing point, providing insights into the market’s strength or weakness.

When the market retraces to the 78.6% level, it prompts traders to reassess their positions and strategies. If the price holds above this level, it may suggest a continuation of the bullish trend, while a drop below could signal a bearish reversal. Understanding the implications of the 78.6% retracement can significantly impact trading decisions, allowing traders to adjust their strategies accordingly.

Utilizing Market Analysis for Effective Trading

Effective market analysis is crucial for successful trading, and combining tools like Fibonacci retracements and Gann squares can lead to enhanced decision-making. Traders at ONE44 leverage these techniques to analyze price movements, identify key levels of support and resistance, and develop strategic trading plans. By understanding market dynamics, traders can navigate volatility and capitalize on opportunities.

Moreover, one of the key benefits of thorough market analysis is the ability to remain proactive rather than reactive. By anticipating potential price movements based on historical patterns and established levels, traders can position themselves advantageously. This proactive approach, underpinned by robust analysis, ultimately contributes to a trader’s success in the competitive environment of futures trading.

The Importance of Risk Management in Trading Strategies

Risk management is a cornerstone of successful trading, particularly when utilizing technical analysis tools such as Fibonacci retracements and Gann squares. By establishing clear risk parameters and understanding the limitations of these tools, traders can protect their capital while maximizing potential gains. This is especially important, as futures trading inherently involves significant risks.

Incorporating risk management strategies alongside Fibonacci levels allows traders to set appropriate stop-loss orders, ensuring they exit trades before incurring substantial losses. By understanding the relationship between market levels and potential price movements, traders are better equipped to make informed decisions that align with their risk tolerance. Ultimately, effective risk management is essential for long-term trading success.

Leveraging Fibonacci Retracements for Long-Term Trading Success

Fibonacci retracements play a vital role in long-term trading strategies, serving as a foundation for identifying critical market levels. Traders can use these retracement levels to forecast future price movements based on historical data, facilitating more strategic planning. By understanding how these levels interact with Gann squares, traders can develop a comprehensive approach to market analysis that supports long-term goals.

For instance, when a market consistently respects Fibonacci levels over time, it often indicates strong underlying trends. By aligning long-term trading strategies with these levels, traders can take advantage of significant price movements while minimizing exposure to short-term fluctuations. This disciplined approach fosters confidence in trading decisions and contributes to sustained success in the dynamic world of futures trading.

Educational Resources for Mastering Fibonacci and Gann Techniques

To excel in trading, continuous education is essential, particularly when it comes to mastering tools like Fibonacci retracements and Gann squares. At ONE44, we offer a wealth of resources, including videos and tutorials, to help traders understand and apply these techniques effectively. By investing time in education, traders can build a solid foundation for their trading strategies.

Moreover, learning from experienced traders and analysts can provide valuable insights into the nuances of market analysis. Engaging with educational content not only enhances a trader’s understanding of Fibonacci levels and Gann squares but also fosters a community of like-minded individuals who share similar trading goals. This collaborative learning environment ultimately contributes to a trader’s growth and success.

Frequently Asked Questions

What are Fibonacci retracements and how do they relate to market analysis?

Fibonacci retracements are technical analysis tools used to identify potential support and resistance levels in financial markets by measuring the distance of a price movement and applying key Fibonacci ratios. These levels, such as 23.6%, 38.2%, 61.8%, and 78.6%, indicate where a market might reverse or consolidate, making them essential in market analysis and trading strategies.

How can Fibonacci retracements be used to identify support and resistance levels?

Fibonacci retracements help traders identify potential support and resistance levels by plotting horizontal lines at the key Fibonacci levels on a price chart. When the price retraces to these levels after a significant move, traders can anticipate potential reversals or continuation patterns, thus effectively utilizing Fibonacci levels in their trading strategies.

What is the significance of the 61.8% Fibonacci retracement level in trading strategies?

The 61.8% Fibonacci retracement level is often considered a critical point for potential market reversals. When prices approach this level, it can indicate strong buying or selling pressure, leading to significant fluctuations. Traders frequently watch this level for entry or exit signals in their trading strategies.

How do Fibonacci retracements compare to Gann squares in market analysis?

Fibonacci retracements and Gann squares are both tools used in market analysis to identify support and resistance. While Fibonacci retracements focus on price levels based on the Fibonacci sequence, Gann squares utilize geometric angles and time cycles. Combining both methods can enhance trading strategies by providing a more comprehensive view of market dynamics.

Can Fibonacci retracements predict market trends effectively?

Fibonacci retracements can help predict market trends by highlighting key retracement levels where price reversals may occur. However, they should be used in conjunction with other technical analysis tools and indicators to increase reliability. Effective market predictions often require a holistic approach that includes Fibonacci levels, market sentiment, and other analytical methods.

What trading strategies can be developed using Fibonacci retracements?

Traders can develop various strategies using Fibonacci retracements, such as identifying entry points at key levels (like 38.2% or 61.8%), setting stop-loss orders just beyond these levels to manage risk, and employing multiple Fibonacci retracement levels to establish targets for profit-taking. Integrating these strategies with overall market analysis enhances their effectiveness.

How does the 78.6% Fibonacci retracement level influence market behavior?

The 78.6% Fibonacci retracement level often indicates a strong potential for reversal or continuation of the existing trend. If the market fails to establish a new high or low near this level, it can lead to a sharp sell-off or buying opportunity, making it crucial for traders to monitor this level closely in their analysis and strategies.

Why is it important to understand Fibonacci levels in conjunction with Gann squares?

Understanding Fibonacci levels in conjunction with Gann squares is important because it allows traders to utilize a multi-faceted approach to market analysis. By aligning Fibonacci retracement levels with Gann square intersections, traders can better identify significant support and resistance points, enhancing their decision-making process and improving overall trading strategies.

What resources are available for learning more about Fibonacci retracements?

There are numerous resources available for learning about Fibonacci retracements, including online courses, webinars, and instructional videos. ONE44 Analytics has produced a series of videos that explain how to effectively utilize Fibonacci retracements in trading, making it a valuable resource for both novice and experienced traders.

How can I apply Fibonacci retracements to my trading plan?

To apply Fibonacci retracements to your trading plan, start by identifying a recent significant price move, then use the Fibonacci tool to plot key retracement levels on your chart. Monitor these levels for potential entry and exit points, and combine them with additional indicators and market analysis to refine your trading strategy.

| Key Points | Details |

|---|---|

| Fibonacci Retracements Overview | Fibonacci retracements are used to identify potential support and resistance levels in the market. |

| 38.2% Level | Maintains the trend; expected to lead to new highs or lows. |

| 23.6% Level | Indicates market strength or weakness. |

| 61.8% Level | Can result in significant fluctuations and keep the market trading within a range. |

| 78.6% Level | May signify the end or beginning of a bull market, influencing market movement significantly. |

| Market Behavior Example | As of 1/26/25, market behavior around 78.6% retracement suggests caution, with potential for sharp sell-off if new highs are not established. |

| ONE44 Analytics | Focuses on actionable insights using Fibonacci retracements and Gann squares, applicable across various markets. |

Summary

Fibonacci retracements are a crucial tool in technical analysis, aiding traders in identifying potential reversal levels in market trends. This method, combined with Gann squares, provides a comprehensive approach to understanding market dynamics. By using Fibonacci retracement levels such as 38.2%, 61.8%, and 78.6%, traders can make informed decisions based on historical price movements, enhancing their chances of success in the markets.