The Los Azules copper project is quickly emerging as a pivotal investment opportunity in Argentina, driven by McEwen Mining’s strategic push for admission to the country’s attractive investment incentives regime. With an estimated budget of US$2.7 billion, this premier copper venture promises to become one of the top undeveloped copper deposits globally, garnering significant interest from industry giants. McEwen Mining aims to elevate its operations through extensive backing, with TNR Gold Corp already celebrating the project’s potential, especially given its 0.4% net smelter royalty. The substantial investment will not only advance feasibility studies but also facilitate further exploration and initial construction efforts. As mining royalties and attractive corporate tax rates further define the landscape of this ambitious project, it symbolizes both growth and opportunity for investors in the copper sector.

The Los Azules copper initiative represents a transformative development in Argentina’s mining landscape, particularly following McEwen Mining’s recent proposal for government-backed investment opportunities. This ambitious undertaking, valued at approximately US$2.7 billion, aims to exploit one of the world’s largest untapped reserves of copper, appealing to a broad spectrum of stakeholders. With a robust focus on mitigating mining royalties and leveraging country-specific incentives, the project exemplifies the potential rewards of mining in regions rich in natural resources. TNR Gold Corp’s involvement further underscores the lucrative prospects associated with this venture, as they hold a stake in the project’s success through their royalty agreement. Ultimately, the Los Azules project not only highlights the prospective growth in copper production but also reinforces Argentina’s reputation as an emerging mining powerhouse.

Overview of the Los Azules Copper Project

The Los Azules copper project, initiated by McEwen Mining, is poised to become a significant contributor to Argentina’s mining sector and the global copper supply chain. With an estimated investment of US$2.7 billion, this project stands out as one of the largest undeveloped copper deposits worldwide, indicating a robust potential for future growth. The project’s strategic location in Argentina is enhanced by the country’s favorable investment climate, marked by the introduction of substantial investment incentives aimed at attracting foreign capital and expertise in mining.

As McEwen Mining seeks to advance the Los Azules project, the backing from significant industry players, including firms like Rio Tinto, underscores its importance in the global copper market. The project’s development is not merely about extracting resources; it’s also about fostering sustainable practices that comply with modern mining regulations and environmental standards. The focus on copper is particularly relevant given the metal’s increasing demand in various industries, including electric vehicle production and renewable energy technologies.

Investment Incentives for Mining in Argentina

Argentina’s investment incentives, specifically the Regime of Promotion for Investments in Mining (RIGI), are designed to stimulate the mining sector by reducing tax burdens and facilitating project financing. For McEwen Mining’s Los Azules copper project, admission to RIGI can mean a significant reduction in corporate income tax from 35% to 25%, which can substantially enhance the project’s financial viability. Furthermore, exemptions from value-added taxes during the construction phase can lead to considerable savings, allowing more resources to be allocated towards development.

These incentives not only appeal to major mining companies but also create opportunities for smaller players and investors. The assurance of international arbitration access mitigates risks associated with potential disputes between companies and the government, instilling greater confidence among investors. As TNR Gold Corp holds a royalty interest in the Los Azules project, these incentives can potentially streamline project timelines and enhance revenue generation for stakeholders, ultimately contributing to economic growth in the region.

TNR Gold Corp and Its Role in the Los Azules Project

TNR Gold Corp plays a crucial role in the Los Azules copper project as the holder of a 0.4% net smelter royalty. This strategic position allows TNR Gold to benefit from the success of the project without incurring the direct costs involved in project development. The company’s CEO, Kirill Klip, has noted that McEwen Mining’s application for RIGI marks a significant milestone, potentially accelerating the timeline toward construction decisions that could be made following the feasibility study release.

TNR’s business model focuses on leveraging partnerships with established industry leaders like McEwen Mining. By allowing these operators the freedom to develop projects, TNR can generate equity-style returns through royalty cash flows. This collaboration embodies a symbiotic relationship where both entities can thrive, maximizing shareholder value while minimizing operational risks, particularly in a country with evolving mining regulations and incentives.

Copper Deposits and Their Global Importance

Copper is an essential metal in various industries, primarily due to its excellent conductivity and malleability, making it crucial for electrical applications and renewable energy technologies. The Los Azules copper project capitalizes on these growing demands, positioning itself among the top candidates to fulfill future global copper supply requirements. With the increased push for electric vehicles and green technology, the importance of stable and sustainable copper deposits like Los Azules becomes even more significant.

By ranking amongst the largest undeveloped copper deposits nationally and globally, Los Azules is strategically critical for not just Argentina but for the global market. The increasing recognition of copper’s role in energy transitions highlights the potential long-term value of investing in projects associated with abundant mineral resources. As developments progress, the Los Azules project may be a key player in meeting the surge demand for copper in the coming years.

Mining Royalties and Economic Impact

Mining royalties are crucial mechanisms that allow governments and local communities to benefit from the extraction of natural resources. In the case of the Los Azules copper project, TNR Gold’s 0.4% net smelter royalty illustrates how stakeholders can secure financial returns from significant mineral deposits. These royalty arrangements foster a collaborative environment where companies can mobilize resources effectively while ensuring that a portion of revenues supports local economies and development initiatives.

Moreover, the economic impact of mining royalties extends beyond immediate financial returns. These proceeds can fund essential public services, infrastructure development, and community programs that enhance the quality of life for local populations. In Argentina, leveraging mining royalties from substantial projects like Los Azules can help address social challenges while promoting sustainable economic growth and stability in mining regions.

The Future of McEwen Mining in Argentina

McEwen Mining’s strategic planning around the Los Azules copper project signifies a commitment to shaping the future of mining in Argentina. The decision to engage with the RIGI program reflects an understanding of the potential economic benefits and the importance of government support in advancing large-scale mining ventures. As the feasibility study progresses and the project gears towards construction, McEwen is well-positioned to play a leading role in the Argentine mining landscape.

Furthermore, ongoing collaborations with key industry players can enhance operational efficiencies and technological advancements in the project. McEwen Mining’s reputation as an established producer, coupled with the backing of well-established partners, paves the way for future developments not only in Los Azules but also in other mining initiatives across Argentina. This outlook promises growth opportunities amid an evolving sector landscape.

Market Potential for Copper Investments

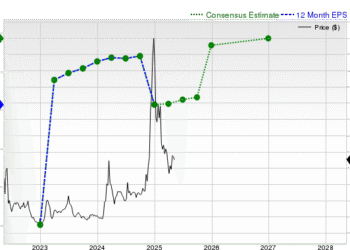

The copper market is witnessing a resurgence driven by global economic growth and the increasing emphasis on green technologies. As industries pivot toward sustainable practices, copper’s role in manufacturing renewable energy solutions and electric vehicles has never been more critical. The investment landscape for copper, especially for major projects like Los Azules, indicates a fertile ground for significant financial inflows and development.

Moreover, as countries seek to reduce their carbon footprints and navigate the transition to sustainable energy systems, reliable sources of copper become paramount. Investors are looking closely at projects that demonstrate not only economic viability but also environmental responsibility. McEwen Mining’s Los Azules copper project is positioned to attract such investment, making it an exciting opportunity for stakeholders in the mining sector.

Environmental Considerations in Mining

As the mining industry progresses, environmental sustainability has become a core consideration in project development. The Los Azules copper project, acknowledging global concerns regarding ecological footprints, is expected to adopt sustainable mining practices that align with international standards. This proactive stance is essential for gaining community support and ensuring regulatory compliance, particularly in a country like Argentina where environmental considerations are increasingly emphasized.

Investing in cleaner technologies and responsible mining practices will not only preserve natural resources but also improve the overall sustainability of mining operations. This emphasis on environmental stewardship in projects like Los Azules aligns with the growing trend among consumers and investors for responsible sourcing of materials, especially those vital for green technologies. McEwen Mining’s commitment to safeguarding environmental integrity can potentially enhance the project’s reputation and attractiveness in the global market.

TNR Gold’s Strategic Alliances for Future Prospects

TNR Gold’s strategic alliances with industry leaders like McEwen Mining create a robust framework for future prospects in the mining sector. By fostering partnerships with companies that prioritize operational efficiency and innovation, TNR is positioned to leverage its royalty interests for maximum shareholder value. The company’s focus on securing royalties ensures a steady revenue stream without the operational responsibilities related to mining activities.

Such strategic alignments are especially critical in a dynamic industry influenced by market trends and regulatory changes. TNR Gold’s commitment to aligning with operators like McEwen Mining establishes a safe pathway for growth and resilience, particularly in favorable mining jurisdictions like Argentina. As the landscape evolves, TNR’s alliances will continue to play a vital role in unlocking the potential of lucrative projects like Los Azules.

Frequently Asked Questions

What is the Los Azules copper project and who is behind it?

The Los Azules copper project is a major mining initiative led by North American producer McEwen Mining, through its subsidiaries McEwen Copper and Andes Corporación Minera SA. It is one of the largest undeveloped copper deposits globally and is currently being prepared for development in Argentina.

How does Argentina’s investment incentive regime affect the Los Azules copper project?

Argentina’s investment incentive regime (RIGI) offers significant benefits for the Los Azules copper project, including a reduced corporate income tax rate from 35% to 25%, exemptions from value-added tax during construction, and relief from export duties, which make the project more economically viable.

What are the estimated costs associated with the Los Azules copper project?

The estimated costs for the Los Azules copper project total approximately US$2.7 billion, which includes US$227 million allocated for a feasibility study and exploratory activities, alongside a projected US$2.5 billion needed for construction and development of the mine and production facilities.

What is TNR Gold Corp’s involvement with the Los Azules copper project?

TNR Gold Corp holds a 0.4% net smelter royalty on the Los Azules copper project, which allows them to benefit financially without needing to invest capital into its development. This partnership positions TNR Gold to potentially gain significant returns as the project advances.

Why is the Los Azules copper project significant in the mining industry?

The Los Azules copper project is significant due to its status as one of the world’s ten largest undeveloped copper deposits and because of the support it has received from major industry players like Rio Tinto, enhancing its potential for impactful future production.

What are the potential benefits for McEwen Mining from the Los Azules copper project?

McEwen Mining stands to gain significantly from the Los Azules copper project through increased production capacity, access to international arbitration for dispute resolution, and substantial financial relief provided by Argentina’s investment incentives, thereby enhancing its market competitiveness.

What role do mining royalties play in the Los Azules copper project?

Mining royalties, such as the 0.4% net smelter royalty held by TNR Gold Corp on the Los Azules copper project, provide a revenue stream for royalty holders as the project progresses. These royalties can significantly contribute to the financial performance of companies involved without requiring direct investment in the mining operations.

How does the development of the Los Azules copper project align with global copper demand?

The development of the Los Azules copper project aligns with global copper demand, which is expected to rise due to increasing needs for renewable energy solutions and electric vehicles, making copper a critical resource. This positions the project favorably in the market as a future source of copper supply.

| Key Point | Details |

|---|---|

| TNR Gold Corp Response | Welcomes McEwen Mining’s submission of the Los Azules copper project for investment incentives. |

| Investment Amount | Project valued at US$2.7 billion with US$227 million committed under Argentina’s RIGI for feasibility and exploration. |

| RIGI Benefits | Includes reduced corporate tax rate, relief from VAT, export duty exemptions, and access to international arbitration. |

| Undeveloped Deposit | Los Azules is one of the largest undeveloped copper deposits globally, supported by major players like Rio Tinto. |

| TNR Gold Royalty | Holds a 0.4% net smelter royalty, ensuring potential for significant returns without capital contribution. |

| Mariana Lithium Project | TNR also holds a 1.5% royalty on Mariana lithium project, enhancing overall portfolio value. |

| Phase 1 Production | Ganfeng’s Mariana project begins production with 20,000 tonnes annual capacity, boosting profitability. |

Summary

The Los Azules copper project represents a significant opportunity in the mining sector, with McEwen Mining seeking to leverage Argentina’s RIGI for substantial investment benefits. The project aims to position itself as a key player among the world’s largest undeveloped copper deposits, with robust support from established industry leaders. As TNR Gold Corp holds a beneficial royalty interest in the project, they stand to gain from the development and success of the Los Azules project without direct financial risk, signaling a positive outlook for all stakeholders involved.