In the world of stock trading, observing unusual put options activity can reveal significant insights, and today, MSFT stock unusual put options activity has caught the attention of investors. This unusual activity often indicates that institutional investors are making strategic moves, potentially signaling their belief in the future direction of Microsoft’s stock value. Notably, with Microsoft shares currently trading at $451.02, this trading behavior could suggest a bullish sentiment amid an overall positive trend, following an 11.2% rise from recent lows. By analyzing the put options yield and other metrics, traders can gauge market confidence and make informed decisions in MSFT options trading. This article will delve deeper into the implications of this unusual stock options activity and what it means for the future of Microsoft stock.

When it comes to assessing stock performance, the trading of out-of-the-money put options in Microsoft Corporation (MSFT) provides a fascinating glimpse into market sentiment. Such unusual activity in stock options trading often reflects the strategic moves of savvy investors, particularly those betting on the stock’s resilience or potential undervaluation. As MSFT continues to demonstrate strong fundamentals, the implications of these bullish put options suggest that large players in the market are positioning themselves to capitalize on anticipated price movements. By exploring the dynamics of put options yield and the confidence exhibited by traders, we can uncover the underlying value driving MSFT stock. This discussion will further illuminate how such trading patterns can influence investment strategies within the tech sector.

Understanding Unusual Put Options Activity in MSFT Stock

Unusual put options activity in Microsoft stock (MSFT) has recently garnered attention, particularly as investors analyze the implications of large out-of-the-money (OTM) trades. Such activities can indicate a divergence in market sentiment, highlighting potential undervaluation of the stock. For instance, the recent trading of nearly 2,300 put contracts with a January 31, 2025 expiration at a $425 strike price, significantly below the current trading price, suggests that institutional investors are positioning themselves for a bullish outcome. This scenario is particularly intriguing given MSFT’s recent price surge of over 11.2% from its lows, which signals a robust recovery and increasing confidence among investors.

Moreover, the attractive yield of 1.124% on these put options indicates that the short-sellers are not just speculating, but are also willing to earn a return while potentially acquiring more shares at a lower price. The underlying rationale for such trades often stems from a belief that the stock is undervalued, especially in light of recent earnings reports and analysts’ revised price targets. This unusual activity can provide insights into the market’s expectations regarding MSFT’s future performance.

Investors engaging in MSFT options trading must consider the broader implications of unusual put options activity. The confidence exhibited by institutional investors through these trades often reflects a calculated risk, where they foresee minimal downside in the stock over the near term. By selling these OTM puts, they are essentially betting that MSFT will not dip below the strike price, indicating a bullish sentiment on the stock’s stability. Such strategies can be particularly effective in a rising market, where investors aim to leverage their positions without committing substantial capital upfront.

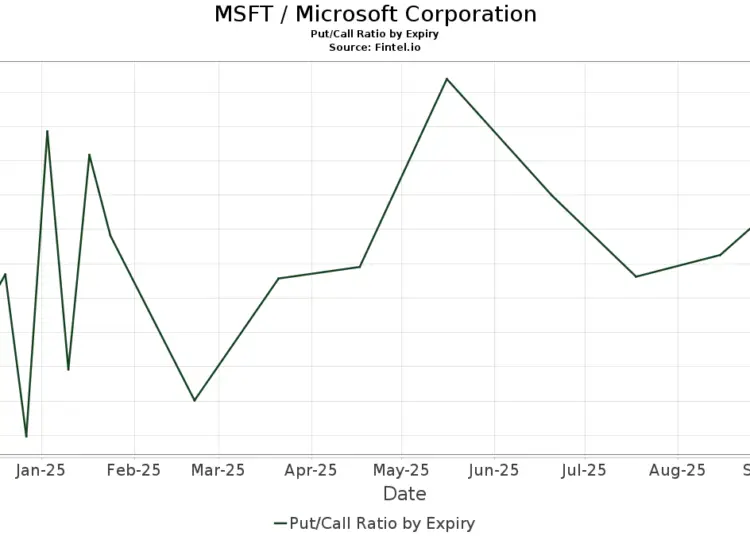

In addition, the volume of put options traded can also signal market trends, providing valuable information for those keen on understanding the dynamics of MSFT stock. Analyzing the history of unusual stock options activity often reveals patterns that can guide future trading decisions. Investors should therefore look closely at these indicators, as they not only highlight confidence in MSFT’s current valuation but also reflect the broader sentiment in the technology sector.

The Significance of Bullish Put Options in MSFT Trading

Bullish put options strategies have become increasingly popular among investors looking to capitalize on perceived undervaluation in stocks like Microsoft (MSFT). By selling put options, investors can generate income through premiums while also positioning themselves to purchase shares at a lower price if the market moves against them. This strategy is particularly appealing in the current landscape, where MSFT stock has shown resilience and potential for future growth. The recent surge in MSFT’s stock price, coupled with the unusual put options activity, suggests that investors are confident about the company’s long-term prospects despite short-term fluctuations.

Furthermore, the bullish sentiment reflected in these put options can serve as a counter-narrative to negative market sentiment, often driven by external factors such as economic indicators or geopolitical tensions. When large investors engage in selling OTM put options, they are essentially signaling their belief in the stock’s strength, which can encourage other investors to follow suit. This collective confidence can create a supportive environment for MSFT’s stock price, reinforcing its upward trajectory and enhancing overall market stability.

In light of this bullish put options activity, it’s essential for traders to reassess their strategies in MSFT options trading. The yield generated from these put options can act as a cushion against potential declines, making it an attractive alternative for those looking to enhance their portfolios without fully committing to outright stock purchases. Moreover, with analysts raising their price targets for MSFT as a result of its strong financials, the appeal of bullish put options is further amplified. Investors might find that such strategies not only provide immediate returns but also position them favorably for long-term gains in a thriving tech market.

Analyzing Microsoft Stock Value and Future Potential

Microsoft’s stock value has been a focal point for investors, especially in light of its recent performance and the implications of unusual put options activity. Analysts have indicated that MSFT could be undervalued, with price estimates projecting a target of $548.88 per share based on strong financial fundamentals and free cash flow metrics. This potential growth aligns with the recent bullish trades observed in the options market, suggesting that savvy investors are positioning themselves to benefit from what they perceive as a mispricing of the stock.

The underlying value of MSFT stock is further supported by its robust financial health and consistent revenue growth. As Microsoft continues to expand its offerings and capture market share in cloud computing and other sectors, the prospects for price appreciation appear bright. Investors leveraging put options in this context can not only benefit from immediate yields but also set themselves up for substantial gains should the stock reach or exceed analysts’ targets.

Moreover, the recent adjustment in analysts’ price forecasts for Microsoft indicates a growing consensus on its strong financial outlook, which could lead to increased investor interest. As these projections climb, more traders may flock to MSFT options trading, particularly in bullish put strategies. This influx of interest can create a positive feedback loop, where rising expectations lead to higher stock prices, further validating the confidence expressed through unusual stock options activity.

In conclusion, the interplay between MSFT stock value and options trading strategies underscores the importance of staying informed about market dynamics. Investors who understand these relationships can make more strategic decisions, taking advantage of opportunities presented by unusual put options activity while aligning their portfolios with the expected growth trajectory of Microsoft.

Implications of Institutional Investor Activity in MSFT Options

The increasing involvement of institutional investors in Microsoft options trading, particularly through unusual put options activity, carries significant implications for the stock’s future. When large players engage in these trades, it often reflects a strong belief in the stock’s value proposition, which can influence market sentiment and drive price movements. In the case of MSFT, the recent trading of a substantial number of OTM put contracts suggests that institutional investors are not only confident in the stock’s current trajectory but are also positioning themselves for potential price corrections that could result in acquiring shares at a discounted rate.

Moreover, the activity of institutional investors often serves as a bellwether for retail investors, who may look to these movements as indicators of market confidence. This can lead to increased trading volume and can amplify price actions in the stock. As MSFT continues to demonstrate resilience and strong fundamentals, the presence of institutional investors engaging in bullish put options can create a reinforcing cycle of confidence, potentially leading to further upward momentum in the stock price.

Additionally, the strategic choices made by institutional investors can also provide valuable insights for individual traders. By analyzing the types of options being traded, along with the volumes and expiration dates, retail investors can gain a clearer picture of market expectations. For instance, the current unusual put options activity in MSFT can be a signal that many believe the stock is undervalued at its current price. This information can guide retail investors in making informed decisions regarding their own trading strategies, whether they are looking to enter new positions or adjust existing ones.

In conclusion, understanding the implications of institutional activity in MSFT options is crucial for investors seeking to navigate the complex landscape of stock trading. By paying attention to these signals, investors can better align their strategies with market trends and capitalize on the opportunities presented by unusual stock options activity.

Strategies for Capitalizing on MSFT Options Activity

Investors looking to capitalize on unusual options activity in Microsoft (MSFT) should consider various strategies that align with their risk tolerance and market outlook. One effective approach is to engage in a bullish put spread, where investors sell OTM put options while simultaneously buying lower strike puts. This strategy allows investors to limit potential losses while still benefiting from the premium received from the sold puts. Given the recent unusual put options activity, this could be a strategic way to profit from anticipated price stability or appreciation in MSFT stock.

Another viable strategy is to combine options trading with equity positions. Investors who already hold MSFT shares may consider selling puts to generate additional income while they wait for potential price increases. This approach not only enhances cash flow but also prepares investors to acquire more shares at a favorable price should the stock decline. With MSFT’s strong fundamentals and positive analyst outlook, such strategies can effectively enhance portfolio returns while mitigating risks associated with market volatility.

Investors might also explore the use of covered put strategies, which involve shorting MSFT stock while selling put options. This strategy can be particularly advantageous in a sideways or bearish market, providing a way to generate income while protecting against significant losses. By combining short positions with the premium received from put sales, investors can create a balanced approach that capitalizes on market conditions. Given the current bullish put options activity, this might be an opportune moment for investors to implement such strategies.

In summary, there are multiple strategies investors can adopt to take advantage of MSFT options activity. By understanding the dynamics of unusual put options and aligning their trading approaches accordingly, investors can enhance their chances of success in the competitive landscape of options trading.

Frequently Asked Questions

What does unusual put options activity in MSFT stock indicate?

Unusual put options activity in MSFT stock often signals investor sentiment regarding the stock’s future performance. When a large number of out-of-the-money (OTM) put options are traded, it typically suggests that institutional investors believe the stock is undervalued and are confident that MSFT will not decline significantly in the near term.

How does the recent unusual put options activity relate to Microsoft stock value?

The recent unusual put options activity in MSFT stock highlights the underlying value perceived by investors. With MSFT trading at $451.02, the trading of OTM puts at a strike price of $425 indicates that investors may see potential upside in the stock, suggesting that it could be undervalued compared to its intrinsic worth.

What is the significance of the $425 strike price in MSFT options trading?

The $425 strike price for the unusual put options activity in MSFT stock is significant because it is 5.77% below the current trading price. This suggests that investors are willing to bet on MSFT’s stability, as they expect the stock to remain above this level until the options expire.

Can bullish put options strategies indicate confidence in MSFT stock?

Yes, bullish put options strategies, such as shorting OTM puts, indicate a high level of confidence in MSFT stock. Investors engaging in such strategies believe the stock will not fall below the strike price, demonstrating a bullish outlook on its future performance.

What is the yield associated with put options trading in MSFT stock?

The recent put options trading in MSFT stock has shown an attractive yield of 1.124%, which equates to an annualized expected return of approximately 9.3%. This yield is appealing to investors who short these puts, as it provides compensation while they await potential stock price movements.

How do analysts’ price targets affect the perception of MSFT stock value?

Analysts’ price targets play a crucial role in shaping market perceptions of MSFT stock value. Recent upward revisions in these targets, now averaging around $507.50, suggest growing confidence in the stock’s potential for appreciation, reinforcing the bullish sentiment reflected in the unusual put options activity.

What should investors consider when analyzing unusual stock options activity in MSFT?

Investors should consider the volume and strike prices of unusual stock options activity in MSFT, as well as the overall market sentiment and fundamental analysis of the company’s financial health. Such factors can provide insights into potential price movements and investment opportunities.

| Key Points |

|---|

| Unusual out-of-the-money (OTM) put options traded in MSFT stock reflect bullish sentiment from investors. |

| MSFT stock is currently trading at $451.02, up 11.2% from a recent low of $405.57 post earnings report. |

| Nearly 2,300 OTM put contracts traded for January 31, 2025, at the $425 strike price, indicating investor confidence. |

| The mid-price for these put options is $4.78 per contract, providing a yield of 1.124% for the short-seller. |

| Analysts suggest MSFT stock has an upside potential, with price targets now averaging around $507.50. |

| The fundamentals indicate that MSFT stock may be undervalued based on free cash flow metrics. |

Summary

MSFT stock unusual put options activity has garnered attention due to a significant volume of out-of-the-money put contracts indicating a bullish sentiment among investors. This activity suggests that large institutional investors believe MSFT may be undervalued, as reflected in the stock’s current trading price and analyst price targets. With a strong underlying value and attractive yields from put options, the market is watching closely for potential upward movements in MSFT stock.