Palantir Technologies options trading has become a focal point for investors, particularly in light of its impressive stock performance following the recent Q3 earnings report. Since November 4, when shares of PLTR skyrocketed, the buzz around put options strategies has intensified, as short-sellers eye potential profits amidst the stock’s remarkable rise. With PLTR stock analysis revealing a doubling in value, interest in these financial instruments has surged, especially given the soaring put premiums. Investors are now navigating the complex landscape of investing in PLTR, evaluating the implications of a possible market correction. As the Palantir stock forecast continues to evolve, the dynamics of options trading offer intriguing opportunities for both seasoned traders and newcomers alike.

The trading of options related to Palantir Technologies has garnered significant attention in the investment community, particularly following the stock’s notable ascent post-earnings announcement. Investors are increasingly exploring various strategies, including the put options strategy, as they assess the potential for market fluctuations. In light of the substantial growth in Palantir’s valuation, many are considering the implications of short-sellers in options trading, who are wagering against further price increases. As analysts delve into PLTR stock trends, the conversation around prospective returns and risks has become more pronounced. This evolving scenario invites a closer examination of the future trajectory of Palantir’s stock, as market participants seek to capitalize on its current momentum.

Understanding Palantir Technologies Options Trading

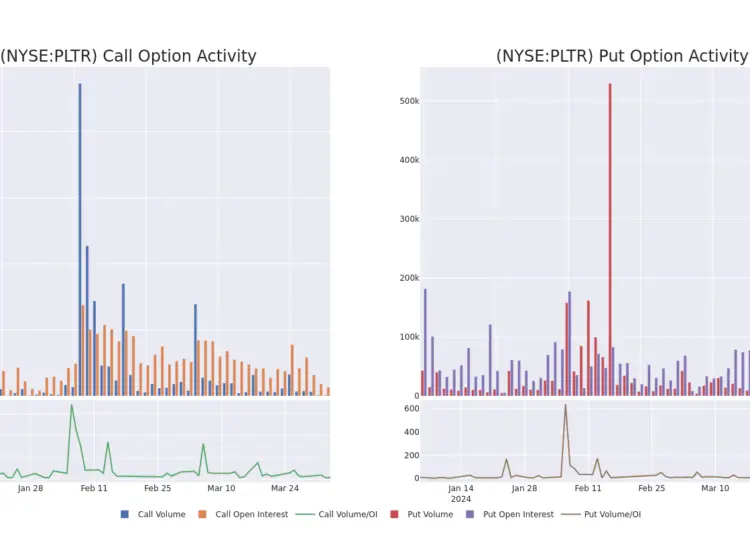

Palantir Technologies (PLTR) options trading has become a focal point for investors looking to capitalize on the stock’s recent volatility. With the significant spike in put options volume following the Q3 earnings report, many traders are speculating on potential price corrections. The unusual activity hints at a strategic shift among traders who may believe that PLTR’s price, having surged dramatically, is now ripe for a correction. This presents an intriguing opportunity for both short-sellers and investors looking to hedge their positions.

The data coming from Barchart’s Unusual Stock Options Activity Report indicates that over 12,500 contracts of $84.00 strike price put options were traded, suggesting a strong bearish sentiment among traders. With the current trading price of $82.38, these put options are classified as in-the-money, providing an intrinsic value and making them an appealing choice for those anticipating a downward trend in Palantir’s stock. Investors need to be aware of the implications of such trading activity as it often foreshadows market sentiment and potential price movements.

PLTR Stock Analysis: A Closer Look at Earnings and Valuation

The recent Q3 earnings report for Palantir Technologies showcased impressive year-on-year revenue growth of 44%, alongside a sequential increase of 14%. Despite these positive financials, the market is grappling with the valuation of PLTR, which currently stands at $187.8 billion. The company’s adjusted free cash flow (FCF) has soared, leaving analysts and investors to ponder whether the current market price reflects an overvaluation. The substantial rise in FCF margins—from 22% in Q2 to an astonishing 60% in Q3—paints a compelling picture of Palantir’s operational efficiency and future potential.

However, such high valuations strain investor confidence, particularly with an FCF yield dipping below 1%. The question arises: is the market willing to sustain a valuation that exceeds 100 times adjusted FCF? The projected growth to over $1 billion in adjusted FCF for 2024 raises optimism, yet it also invites skepticism from those concerned about the sustainability of such growth. Therefore, while the earnings report reflects robust operational performance, the broader market sentiment appears cautious, nudging many investors toward put options as a protective strategy against potential declines.

The Put Options Strategy: A Hedge Against Market Volatility

Utilizing put options as a trading strategy can effectively hedge against market volatility, especially in the context of Palantir Technologies. Investors who purchase put options are essentially betting against the stock, anticipating a decline in its market price. The premium for these put options has increased significantly, indicating that traders are preparing for potential short-term pullbacks after the stock’s remarkable ascent. This strategic move allows investors to mitigate risks associated with holding PLTR shares amid uncertainty.

The current market dynamics suggest that many traders view the put options on PLTR as an attractive income opportunity, particularly with the premiums reflecting a high extrinsic value. As the stock trades close to its strike price, the appeal of short-selling through put options becomes more pronounced. Investors must weigh the potential risks and rewards of this strategy, especially considering the stock’s recent performance. With a yield of 2.786% available to short-sellers, the allure of quick returns may overshadow the inherent risks involved in such transactions.

Short-Sellers in Options: Analyzing Market Sentiment

Short-sellers have increasingly turned to options trading as a means to express their bearish outlook on Palantir Technologies. The recent surge in put options activity signals a growing conviction among traders that the stock may experience a correction following its rapid increase. This sentiment is particularly relevant given the stock’s impressive year-over-year growth, as many investors are now questioning whether such growth can be sustained in the long term. The trading patterns observed suggest a tactical approach to capitalizing on market fluctuations.

Moreover, the willingness of short-sellers to engage in options trading indicates a broader market skepticism regarding PLTR’s valuation. By utilizing put options, they can effectively manage risk while pursuing profit from anticipated price declines. This strategic positioning not only reflects individual trader sentiment but also contributes to overall market dynamics, influencing the trading behavior of other investors. Understanding the motivations of short-sellers in the options market provides valuable insights into potential future movements of PLTR stock.

Palantir Stock Forecast: Future Growth and Market Expectations

The outlook for Palantir Technologies remains a subject of considerable debate among analysts and investors alike. With ambitious projections for revenue growth and adjusted free cash flow, many are optimistic about the company’s future performance. Analysts anticipate that PLTR could exceed $3.48 billion in sales by 2025, which would significantly bolster its market position. However, the challenge lies in how the market values these projections, particularly given the current high valuation metrics.

Investors are keenly interested in the upcoming earnings reports, as they will play a critical role in shaping future forecasts. If Palantir can sustain its momentum and continue to deliver impressive financial results, it may alleviate some of the concerns surrounding its valuation. Conversely, any signs of weakness could trigger a reassessment of the stock’s price, leading to increased activity in the options market as traders adjust their strategies accordingly. The interplay between actual performance and market expectations will be vital in determining the trajectory of PLTR stock.

Evaluating the Risks of Investing in PLTR

Investing in Palantir Technologies comes with its fair share of risks, particularly in light of its recent stock performance and market valuation. While the company has demonstrated remarkable growth, the high price-to-free cash flow ratio raises concerns about whether the stock can maintain its current trajectory. Investors must carefully consider the potential for a market correction, especially with the increasing volume of put options. This heightened activity signals that many market participants are hedging against potential declines, reflecting a cautious sentiment among investors.

Additionally, the volatility associated with PLTR stock means that investors could face significant losses if the market reacts unfavorably to future earnings reports. As traders continue to engage in options strategies to navigate these uncertainties, the risk profile of holding PLTR shares becomes increasingly complex. Understanding these dynamics is essential for investors looking to make informed decisions and manage their portfolios effectively in a volatile market.

The Role of Free Cash Flow in Valuation

Free cash flow (FCF) is a critical metric for evaluating Palantir Technologies’ financial health and long-term potential. With the company’s FCF margins significantly improving, from 22% in Q2 to an impressive 60% in Q3, the outlook appears promising. However, the question remains whether these margins are sustainable and how they will impact the stock’s valuation. Analysts project that Palantir could achieve over $1 billion in adjusted FCF for 2024, yet this optimism is tempered by the current market’s skepticism regarding high valuations.

Investors should closely monitor FCF trends as they provide insight into the company’s operational efficiency and ability to generate cash. A robust FCF performance can lead to increased investor confidence and support a higher valuation for PLTR. Conversely, any signs of declining FCF could trigger a reassessment of the stock’s price, prompting increased activity in both the equity and options markets. Therefore, the interplay between FCF growth and market perception will play a pivotal role in determining the future trajectory of Palantir Technologies.

Market Trends: The Impact of Inflation and Interest Rates

The broader economic environment, including inflation and interest rates, has a profound impact on market trends and stock valuations, including Palantir Technologies. Rising inflation can erode purchasing power, leading to increased costs for businesses and potentially impacting Palantir’s profitability. Additionally, higher interest rates can affect investor sentiment and borrowing costs, creating a challenging environment for growth stocks like PLTR. Investors must remain vigilant about how these macroeconomic factors influence market behavior and stock prices.

In this context, options trading becomes even more relevant as investors seek to hedge against potential downturns. The increasing volume of put options on PLTR indicates that traders are preparing for a possible shift in market sentiment driven by inflationary pressures or changing interest rates. The ability to navigate these external factors will be crucial for Palantir and its investors as they seek to maintain their positions in a volatile market landscape.

Conclusion: Navigating the Future of Palantir Technologies

As Palantir Technologies continues to capture investor interest, navigating the complexities of its valuation and market dynamics will be paramount. The significant appreciation in stock price following the Q3 earnings report has generated optimism, but it has also raised questions about sustainability. Investors must weigh the potential for continued growth against the risks of a market correction, particularly as evidenced by the rising interest in put options. This environment necessitates a strategic approach to investing in PLTR.

Ultimately, the future of Palantir will depend on its ability to deliver consistent financial performance while addressing market concerns regarding valuation. As traders and investors alike engage in options strategies, understanding the underlying factors that drive market sentiment will be essential. By staying informed and adapting to changing conditions, investors can better position themselves to capitalize on opportunities within the realm of Palantir Technologies.

Frequently Asked Questions

What does unusual volume in Palantir Technologies options trading indicate?

Unusual volume in Palantir Technologies (PLTR) options trading, especially in put options, may suggest a potential short-term peak in PLTR stock. This is often seen when investors speculate that the stock may decline after a significant price increase.

How do put options strategies work for investing in PLTR stock?

Investing in PLTR through put options strategies allows investors to profit from a potential decrease in the stock’s price. For instance, if investors purchase put options with a strike price above the current trading price, they are essentially betting that PLTR will fall below that level, making the options more valuable.

What is the significance of PLTR’s stock forecast in relation to options trading?

The stock forecast for Palantir Technologies plays a crucial role in options trading. If analysts predict that PLTR will continue to rise, put options may become less attractive. Conversely, bearish forecasts can lead to increased interest in put options, as traders look to capitalize on potential downturns.

Why are short-sellers interested in Palantir’s options trading?

Short-sellers are drawn to Palantir’s options trading due to the rising premiums for put options. The high extrinsic value makes these puts appealing as a way to hedge against potential declines in PLTR stock while also providing opportunities for profit.

What factors contribute to the rising premiums of PLTR put options?

Rising premiums of Palantir Technologies’ put options can be attributed to the stock’s significant price increase and the market’s uncertainty regarding its valuation. As the stock price fluctuates, traders anticipate potential declines, driving up the demand and price for put options.

How does intrinsic and extrinsic value affect Palantir’s put options?

The intrinsic value of Palantir’s put options reflects the difference between the strike price and the current stock price. In the case of PLTR, as seen with $84 strike price puts trading at a midprice of $2.40, the intrinsic value is $1.62, while the extrinsic value accounts for market expectations and time until expiration.

What is the breakeven price for a Palantir Technologies put option investor?

For a Palantir Technologies put option with a strike price of $84.00, the breakeven price for an investor would be approximately $79.98. This is calculated by subtracting the put option premium from the strike price, indicating the price at which they would neither profit nor lose.

How does Palantir’s financial performance influence options trading?

Palantir’s impressive financial performance, such as significant increases in free cash flow and revenue growth, can impact options trading by affecting investor sentiment. Positive earnings reports may lead to increased demand for call options, while concerns over valuation might drive interest in put options.

What does a low FCF yield indicate for Palantir Technologies stock?

A low free cash flow (FCF) yield, such as below 1.0% for Palantir Technologies, suggests that the stock may be overvalued. This can influence options trading as investors may seek protection via put options if they believe the stock will not sustain its high valuation.

How can short-put yields impact investment decisions in PLTR options?

The short-put yield for Palantir Technologies, like the reported 2.786%, offers potential income for investors willing to take on the risk of owning the stock at a higher price. This yield can make options trading attractive, especially for those who anticipate that the stock will not fall below the strike price before expiration.

| Key Point | Details |

|---|---|

| Significant Put Options Volume | Unusual activity in put options indicates a potential stock peak. |

| Stock Performance | After the Q3 earnings report, PLTR stock has doubled, closing at $82.38. |

| Put Premiums | Put premiums have increased sharply, attracting short-sellers. |

| Trading Data | Over 12,500 contracts of $84.00 strike price put options traded, indicating bearish sentiment. |

| Intrinsic Value of Puts | Puts have an intrinsic value of $1.62 with a midprice of $2.40. |

| Yield for Short Sellers | Short sellers can achieve a yield of 2.786% in two days. |

| Company Growth | Palantir reported a 44% year-on-year revenue growth. |

| Future Projections | Projected adjusted FCF for 2024 is expected to exceed $1 billion. |

| Market Valuation Concerns | Current market valuation is $187.8 billion with a low FCF yield. |

| Investment Decision | Investors’ perceptions of PLTR’s valuation will influence trading strategies. |

Summary

Palantir Technologies options trading is gaining attention due to significant put options activity suggesting a potential peak for the stock. After a remarkable rise post-Q3 earnings, the stock’s valuation raises questions about its sustainability, particularly with a low free cash flow yield. As investors speculate on a potential decline, the allure of short-selling these put options is particularly strong, offering a decent yield in a volatile market. Ultimately, the decision to engage in options trading with Palantir will depend on market perceptions and the company’s ability to justify its high valuation amidst its impressive growth metrics.