Trading strategies are essential tools for investors looking to gain an edge in the complex financial markets. From quantitative trading to options trading strategies, these methodologies enable traders to analyze patterns, forecast potential outcomes, and make informed decisions. Popular stocks like WMT and OKTA often reveal hidden signals that could lead to successful trades, making in-depth trading analysis vital. Notably, understanding the dynamics of RCAT investment can also unveil asymmetric opportunities that might not be apparent at first glance. As you explore various trading strategies, remember that the key to success lies in leveraging data-driven insights and empirical evidence to guide your investment choices.

When discussing market approaches, we often refer to techniques such as investment methodologies, trading tactics, or capital deployment frameworks. These fundamental concepts encompass a range of practices that help traders navigate the volatile landscape of stock exchanges. Whether focusing on algorithmic trading or analyzing specific stocks like Walmart (WMT), Okta (OKTA), or Red Cat (RCAT), it’s crucial for investors to refine their strategies to capitalize on market movements. By utilizing sophisticated trading methods, one can enhance the probability of favorable outcomes while mitigating risks inherent in equity trading. Ultimately, the intricate interplay between diverse trading strategies and stock evaluations can lead to superior investment returns.

Understanding the Science Behind Trading Strategies

In the world of financial analysis, trading strategies need to be grounded in empirical data to yield significant results. The basis of any robust trading strategy starts with quantifying market behavior through quantitative trading methods. By employing rigorous statistical analyses, traders can identify patterns that may not be evident through traditional price charting methods. This approach allows traders to capitalize on edges within the market, leading to more informed trading decisions that outperform generic investments in indices like the S&P 500.

For example, by using quantitative methods such as the binomial test outlined in the content, analysts can derive actionable insights from complex market dynamics. This kind of rigorous analysis doesn’t just reveal superficial patterns but digs deeper to discern the underlying forces affecting stock prices, such as supply and demand fluctuations. Therefore, understanding these scientific methodologies is crucial for traders looking to enhance their performance and maximize returns.

Frequently Asked Questions

What are effective trading strategies for quantitative trading?

Effective quantitative trading strategies often involve the use of statistical methods and algorithms to analyze market data and identify potential trading opportunities. Traders use factors such as historical price patterns, volume trends, and market indicators to inform their decisions. Common strategies include mean reversion, momentum trading, and arbitrage, which aim to harness predictable market behaviors to generate profits.

How can I analyze WMT trading for better investment decisions?

To analyze Walmart (WMT) trading effectively, investors can employ strategies such as the 6-4-D sequence, which monitors price movements over time. Observing patterns like six up weeks followed by four down weeks allows traders to gauge potential future price actions. Employing options trading strategies, such as bull call spreads, can leverage these insights to maximize returns while managing risk.

What should I consider when making an OKTA stock forecast?

When making an OKTA stock forecast, consider recent trading patterns, such as the 4-6-D sequence, which indicates four weeks of gains followed by six weeks of declines. Analyzing these trends with a quantitative lens helps project future price movements. Additionally, monitoring broader market trends, conducting fundamental analysis, and utilizing options trading strategies can provide a comprehensive outlook on OKTA’s stock performance.

What are the key factors influencing RCAT investment opportunities?

Key factors influencing RCAT investment opportunities include examining recent price movement patterns, such as the 6-4-U sequence, which suggests a bullish trend in previous trading weeks. Evaluating the fundamental aspects of RCAT, such as its role in defense contracting and technological advancements, alongside specific trading strategies, can enhance investment decisions while navigating market volatility.

What is the role of options trading strategies in improving trading outcomes?

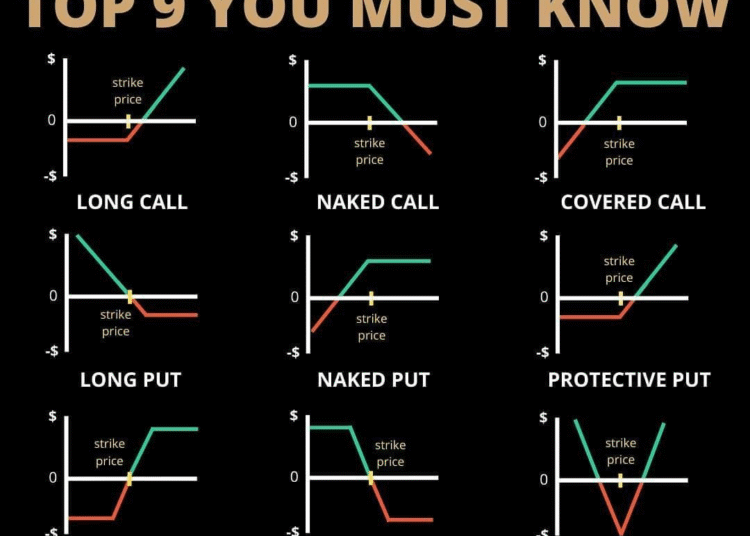

Options trading strategies play a significant role in enhancing trading outcomes by allowing investors to hedge risks and capitalize on price movements without directly owning the underlying asset. Strategies such as bull spreads, straddles, and covered calls enable traders to manage risk exposure, maximize potential gains, and create more defined trading scenarios based on their market outlook.

| Company | Stock Signal | Probability of Price Increase | Potential Trading Strategy | Maximum Payout |

|---|---|---|---|---|

| Walmart (WMT) | 6-4-D sequence: 6 up weeks, 4 down weeks | 76.47% | 95/97 bull call spread | $107 (115% payout) |

Summary

Trading strategies are essential for investors looking to capitalize on market opportunities effectively. In analyzing Walmart (WMT), Okta (OKTA), and Red Cat (RCAT), we can identify unique trading signals that suggest potential upward price movements. Walmart shows a strong probability of price increase after a 6-4-D sequence, while Okta’s recent volatility presents a promising setup for a debit-based strategy. Finally, Red Cat indicates bullish behavior despite its risks, highlighting the diverse opportunities available in trading strategies. By integrating scientific approaches and empirical data in trading, investors can make informed decisions that enhance their chance of achieving alpha returns.