The White Dam gold project is a key asset for GBM Resources, positioned in South Australia, where the company is actively ramping up production while the sale of the mine awaits completion. This gold mining venture has benefited significantly from the introduction of new heap leach material, enhancing production capabilities and boosting revenue. In the current quarter alone, the project has yielded approximately 466 ounces of gold, equating to around $1.9 million in revenue, indicative of the project’s potential amidst a rising gold price increase. CEO Peter Rohner has emphasized the ongoing optimization efforts which promise even greater output in the upcoming quarter. As GBM navigates the sale to Olary Gold Mines, the White Dam gold project continues to be a focal point in the company’s strategy to refine its portfolio and capitalize on favorable market conditions.

The White Dam gold project serves as a vital pillar in GBM Resources’ production strategy, demonstrating the company’s commitment to advancing its gold mining operations in Australia. This site, characterized by its innovative heap leach technique, has shown impressive results, contributing significantly to the overall output of the company. As GBM Resources moves forward with the Olary Gold Mines sale, the project remains a critical element in the ongoing discussions surrounding asset management and market positioning. With the gold price experiencing a notable rise, the interest in the White Dam project is palpable, drawing attention from potential buyers and investors alike. The strategic focus on production enhancement and the potential for increased revenue underscores the project’s vital role in GBM’s future.

Overview of the White Dam Gold Project

The White Dam gold project, located in South Australia, represents a significant asset for GBM Resources (ASX: GBZ). With the introduction of new heap leach material, production levels have seen a notable increase, enhancing the operational efficiency of the mine. This project not only contributes to GBM’s production but also acts as a strategic pillar as the company navigates its ongoing sale process with Olary Gold Mines.

As GBM Resources continues to operate White Dam, the focus is on optimizing the extraction processes to maximize gold recovery. The company’s innovative use of heap leach technology has allowed for better resource management, resulting in a steady output and revenue generation. The current production level of approximately 466 ounces of gold, translating to around $1.9 million in revenue, underscores the mine’s potential even amidst the sale negotiations.

Increasing Production through Heap Leach Technology

Heap leach gold mining has proven to be a successful strategy for GBM Resources, particularly at the White Dam gold project. This method involves stacking crushed ore onto a plastic liner and applying a leaching solution, which helps extract gold more efficiently. The recent incorporation of new heap leach material has been pivotal in boosting production rates, allowing GBM to capitalize on the rising gold prices in Australia.

The benefits of heap leaching extend beyond immediate production increases; they also enhance the overall recovery rates from the ore processed at White Dam. CEO Peter Rohner has noted that the combination of irrigation techniques and mineralized material recovery has significantly influenced production outcomes. As the company continues to optimize these operations, stakeholders can expect even greater production levels moving forward.

Impact of Gold Price Increase

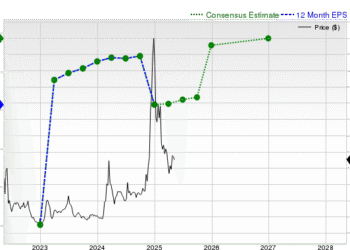

The recent surge in gold prices has had a profound impact on the mining industry, particularly for projects like White Dam. As GBM Resources reports increased revenue from gold sales, the favorable market conditions are amplifying interest in their assets. The higher gold prices not only boost immediate profits but also enhance the overall valuation of the White Dam project as negotiations for its sale progress.

Moreover, the increasing gold prices create a competitive landscape for mining assets. Other parties are reportedly interested in the White Dam project, indicating that the potential for lucrative returns on investment is drawing attention from various investors. GBM’s strategic focus on maintaining and enhancing production during this period is crucial, as it solidifies the project’s standing in the market.

Sale of White Dam: Current Status

In July, GBM Resources announced the sale of its 100% interest in the White Dam gold project to Olary Gold Mines, a decision aimed at refining and optimizing GBM’s overall portfolio. The sale is still pending completion, with Olary working diligently to meet the funding requirements outlined in the agreement. This transaction represents a significant shift for GBM as it adjusts its focus toward other promising projects while still managing White Dam’s operations.

The exclusivity period granted to Olary until July 31, 2024, reflects the strategic importance of the sale for both parties. GBM’s leadership is keenly aware of the asset’s value, especially in light of the ongoing gold price increase. Should the sale to Olary not materialize, GBM is prepared to engage with other interested parties, showcasing the project’s attractiveness in the current market.

Future Prospects for Gold Mining in Australia

The landscape of gold mining in Australia is evolving, with companies like GBM Resources at the forefront of this transformation. As the demand for gold rises globally, Australian projects like the White Dam are positioned to benefit significantly. With innovative mining techniques such as heap leaching being deployed, the efficiency and output of these mines are expected to improve, ensuring their relevance in the market.

Additionally, the focus on sustainable and responsible mining practices is becoming increasingly important for stakeholders. As GBM looks to enhance its production at White Dam while contemplating future sales, aligning operational practices with environmental and social governance will be key in attracting potential investors and partners.

Strategic Focus on Drummond Basin and Twin Hills Project

While the sale of White Dam is a significant aspect of GBM Resources’ strategy, the company is also concentrating on the promising Drummond Basin. This area has shown substantial potential for gold production, and GBM’s recent agreements, such as the partial sale and farm-in with Wise Walkers on the Twin Hills project, highlight the company’s commitment to diversifying its portfolio and maximizing resource extraction.

By strategically focusing on multiple projects, GBM is positioning itself for future growth in the gold mining sector. The exploration and development of new sites alongside the management of White Dam ensure that the company is not solely dependent on one asset for its revenue. This diversified approach is essential in navigating the fluctuating nature of gold prices and market demands.

Management Insights on Production and Sales

Management insights from GBM Resources reveal a keen understanding of the operational challenges and opportunities within the gold mining sector. CEO Peter Rohner has emphasized the importance of ongoing maintenance programs that not only enhance production but also ensure the longevity of the White Dam project. The ability to adapt to market conditions, such as the recent rise in gold prices, has placed GBM in a favorable position within the industry.

Furthermore, the transparency around the sale process for White Dam shows management’s commitment to stakeholder engagement. Keeping investors informed about negotiations with Olary Gold Mines and potential alternative buyers underlines the strategic planning involved in maximizing the value of the asset. This proactive approach is vital in maintaining investor confidence and ensuring the company’s continued success in gold mining.

Challenges in Finalizing the Sale of White Dam

Despite the promising outlook for gold production at the White Dam project, challenges remain in finalizing its sale. Delays in negotiations and the need for Olary Gold Mines to meet funding requirements have created uncertainty around the transaction. Such hurdles can be frustrating for GBM Resources, especially given the asset’s potential value amid rising gold prices.

However, GBM’s contingency plans to engage with other interested parties showcase their adaptability and strategic foresight. The ongoing interest in White Dam demonstrates the asset’s attractiveness in a buoyant market. As GBM navigates these challenges, the company remains focused on enhancing production while positioning itself for a successful sale.

The Role of Heap Leach in Sustainable Mining

Heap leaching plays a critical role in promoting sustainable mining practices, especially at projects like White Dam. This method not only increases gold recovery rates but also minimizes environmental impact compared to traditional mining techniques. By implementing heap leach processes, GBM Resources is able to extract valuable resources while adhering to environmentally responsible practices.

As the mining industry faces increasing scrutiny regarding its environmental footprint, companies that adopt sustainable methods like heap leaching will likely find favor with investors and regulators alike. GBM’s commitment to innovative mining solutions at White Dam reflects a broader trend toward sustainable practices that can enhance profitability while protecting the environment.

Frequently Asked Questions

What is the current production status of the White Dam gold project?

The White Dam gold project, operated by GBM Resources, is currently increasing its production levels. In the latest quarter, approximately 466 ounces of gold have been sold, generating around $1.9 million in revenue. The introduction of new heap leach material has significantly improved production efficiency.

How is GBM Resources enhancing gold production at the White Dam gold project?

GBM Resources is enhancing gold production at the White Dam gold project by introducing new heap leach material into the production circuit. This, combined with mineralized material recovered from the gold room and elution circuits, has led to a significant boost in gold output.

What impact has the increase in gold prices had on the White Dam gold project?

The increase in gold prices, particularly in Australian dollars, has positively impacted revenues from the White Dam gold project. This price surge has contributed to the overall financial performance and production levels at the site.

What is the status of the sale of the White Dam gold project to Olary Gold Mines?

The sale of the White Dam gold project to Olary Gold Mines is currently pending completion. GBM Resources granted Olary an exclusivity period until July 31, 2024, for the sale, which includes a non-refundable deposit of $50,000.

What will happen if the sale of the White Dam gold project to Olary Gold Mines does not proceed?

If the sale of the White Dam gold project to Olary Gold Mines does not proceed, GBM Resources is in discussions with several other parties interested in acquiring the asset. The high gold prices are generating significant interest in the project from multiple investors.

What are the future plans for the White Dam gold project under GBM Resources?

GBM Resources plans to continue enhancing production at the White Dam gold project while finalizing the sale. The company is also focusing on ongoing maintenance programs that could lead to increased gold production in the next quarter.

How does heap leach gold processing work at the White Dam gold project?

Heap leach gold processing at the White Dam gold project involves stacking ore on a leach pad and applying a solution that extracts gold from the ore. This method has been recently optimized with new material, contributing to increased gold recovery rates.

What are the implications of the high gold prices for the White Dam gold project?

High gold prices have significant implications for the White Dam gold project, as they enhance revenue potential and attract interest from potential buyers. GBM Resources is leveraging this favorable market condition to optimize production and explore potential sales.

| Key Point | Details |

|---|---|

| Increased Production | Introduction of new heap leach material has enhanced production, with 466 ounces of gold sold generating $1.9 million. |

| CEO Comments | CEO Peter Rohner noted that new irrigation has boosted production and that further increases are expected next quarter. |

| Sale Status | Sale to Olary Gold Mines is pending completion, with an exclusivity period until July 31, 2024. |

| Alternative Options | GBM is in talks with other parties in case the sale to Olary does not proceed. |

| Future Focus | Despite the sale delays, GBM remains focused on the Drummond Basin and Twin Hills project. |

Summary

The White Dam gold project is currently experiencing increased production due to the introduction of new heap leach material, with significant revenue generated in the last quarter. GBM Resources is actively working towards completing the sale of the project to Olary Gold Mines, while also exploring alternative buyers should the deal not finalize. Overall, the White Dam gold project continues to be a valuable asset for GBM, contributing positively to their portfolio.